Overview

This article walks you through nine essential payment clause templates for agency contracts. These templates are key to making sure you have clear financial agreements and get those payments on time in the world of influencer marketing. Each template dives into specific areas like:

- Late penalties

- Payment schedules

- Reimbursements

- Dispute resolution

It really highlights how structured financial practices can boost your operational efficiency and build trust between agencies and creators. So, how do these templates fit into your work? Let's explore how they can make your life easier!

Introduction

In the fast-paced world of influencer marketing, the efficiency of financial transactions can truly make or break a partnership. As this industry continues to soar—projected to reach a whopping $480 billion by 2027—the need for clear and effective payment clause templates in agency contracts has never been more critical. So, let’s dive into nine essential templates that not only safeguard timely payments but also streamline financial processes. This way, both creators and agencies can thrive amidst the complexities of modern contracts.

How can these templates transform the way agencies manage payments and foster healthier relationships with creators?

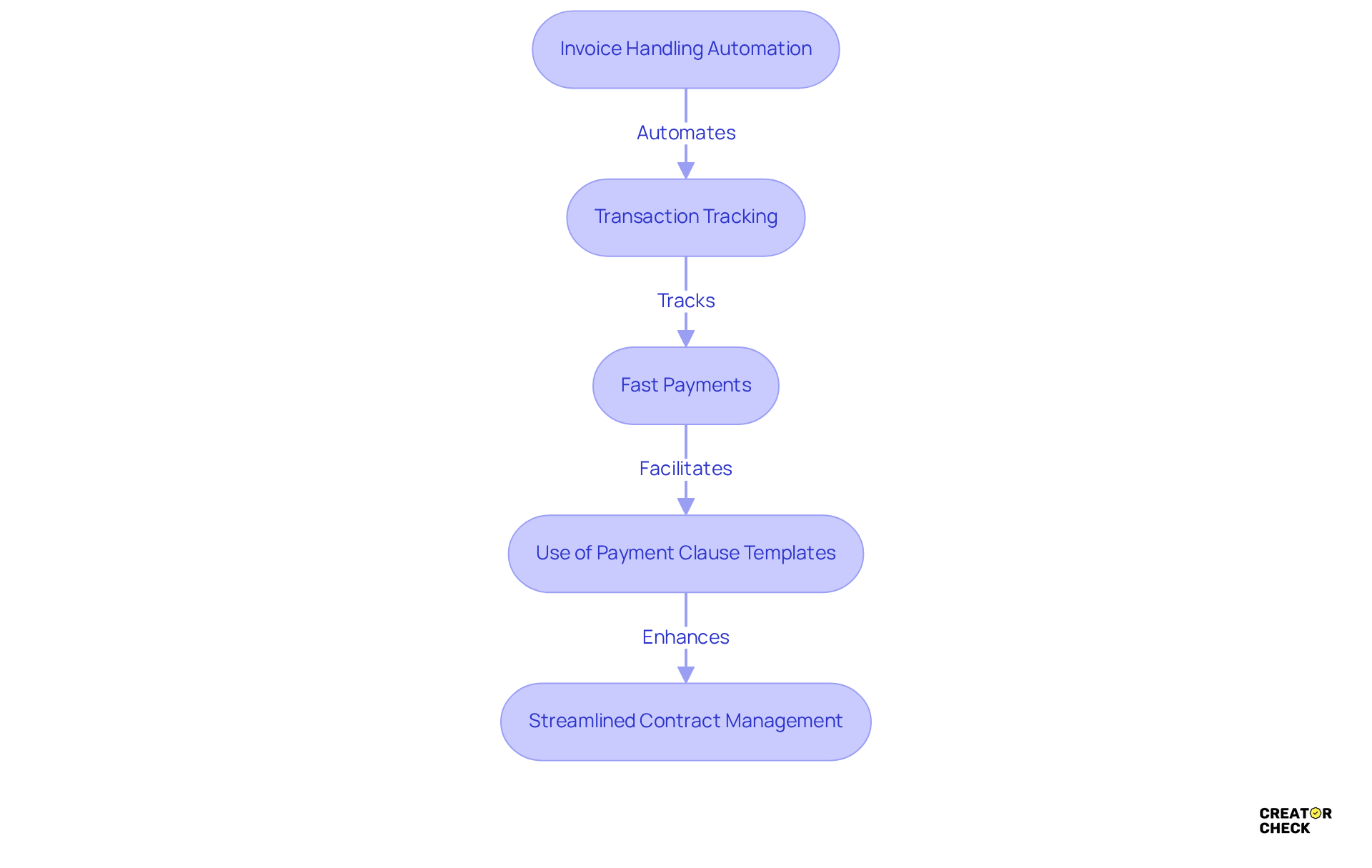

Creator Check: AI-Powered Payment Management for Agency Contracts

Creator Check is here to shake up how organizations manage their finances. With its advanced AI technology, it automates invoice handling and tracks disbursements, which means less time spent on admin tasks. Imagine being able to process about 80% of transactions upfront—just like the bi-weekly payroll system at Pepper Agency. This kind of efficiency lets agencies focus on building strong relationships with creators while keeping their finances crystal clear.

Have you ever noticed how important quick transactions are in the influencer world? Industry leaders highlight that influencers are more likely to jump on partnerships when they know funds will hit their accounts fast. Plus, automating transaction processing simplifies financial dealings and helps agencies stay on top of ever-changing regulations, reducing the risk of delays that can stretch processing times beyond 60 days. And let’s not forget, transactions to global creators can face delays of up to 30 days due to regulatory requirements.

So, what does this mean for you? With Creator Check, agencies can leverage payment clause templates for agency contracts to streamline their contract management through these automated features. This not only drives greater revenue but also boosts operational efficiency in the competitive influencer marketing landscape. It’s all about making your life easier and your business more successful!

Late Payment Penalty Clause Template: Safeguarding Timely Payments

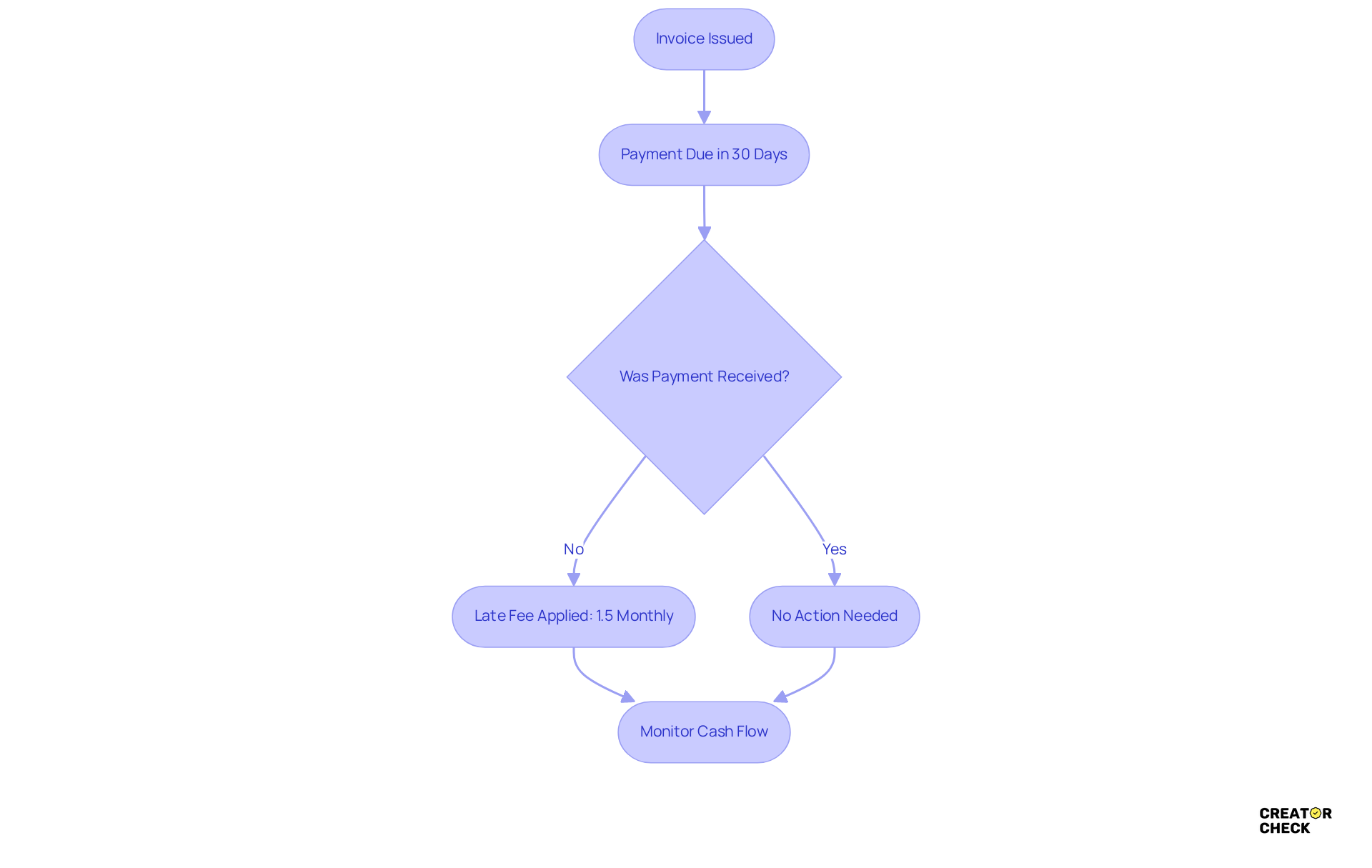

A late fee penalty clause can be a smart way to encourage on-time payments. For instance, it might say: 'If the dues aren't in within 30 days of the invoice date, a late fee of 1.5% per month will be added to the outstanding balance.' This approach not only motivates timely transactions but also sets a clear consequence for delays, which is super important for keeping cash flow healthy in marketing firms.

Now, let’s talk about the influencer marketing scene. It’s currently valued at $250 billion and is projected to reach $480 billion by 2027! With this growth, there’s a rising demand for standardized payment practices. Many creators are pushing for measures like deposits and late fees to ensure they get paid on time for their hard work. As Jazmin Griffith, a full-time creator, puts it, 'But when it comes to getting paid, I have to wait the net 60 or the net 90 [days].' It’s a tough spot, with transaction holds ranging from 30 to 90 days, putting financial pressure on both creators and firms.

Financial experts emphasize the importance of prompt payments, noting that a steady cash flow is crucial for operational stability. By implementing penalties for overdue invoices, organizations can mitigate the risks tied to delayed payments and employ payment clause templates for agency contracts, ultimately fostering healthier financial practices in the marketing ecosystem. The challenges creators face due to late payments underscore the necessity of these provisions, making them vital for both creators and agencies alike.

Payment Schedule Clause Template: Defining Payment Timelines

A clearly outlined provision using payment clause templates for agency contracts is super important for keeping things transparent and minimizing conflicts in influencer agreements. For example, the payment clause templates for agency contracts might include a statement such as:

'Payments shall be made according to the following schedule: 50% upon contract signing, 25% upon completion of the first milestone, and the remaining 25% upon project completion.'

This organized method not only clarifies financial expectations but also aligns incentives between brands and creators.

Best practices show that adopting tiered compensation structures, like divided transactions, can really boost project execution. Think about it: a 50% advance fee followed by the balance upon delivery is becoming the norm that helps reduce risks linked to ghosted deliverables. Plus, always-on promotional programs often use automated Net-30 or Net-15 compensation cycles, treating rewards like a subscription model with recurring deliverables—this can really simplify transaction processes.

Establishing financial timelines in agreements provides multiple benefits, such as enhanced accountability and prompt payments for creators, particularly when using payment clause templates for agency contracts. By clearly outlining milestones in influencer briefs, agencies can use payment clause templates for agency contracts to tie compensation to objective proof of deliverables, which builds trust and cuts down reconciliation errors by up to 70%.

And don’t forget about integrating automated reminders and a defined escalation route for overdue invoices! This can really strengthen your legal stance if disagreements arise, as highlighted in the case study on 'Automated Reminder and Escalation Path.' This organized approach ensures that late dues are managed efficiently, reducing the chances of conflicts.

Now, typical compensation timelines in marketing contracts can vary quite a bit. Micro creators usually accept lower fees along with performance bonuses, while macro creators often ask for larger guarantees. This difference emphasizes the need for organizations to adjust compensation schedules and tax references based on the specific market and influencer type—ensuring clarity and preventing any surprises.

Integrating these organized financial timelines not only streamlines operations but also fosters a more collaborative atmosphere between agencies and creators, ultimately boosting campaign ROI, operational efficiency, and the use of payment clause templates for agency contracts. As Ali Grant puts it,

'When brands hesitate at full upfront charges—often citing internal approval procedures or cash-flow timing—divided fees offer a solution that still reduces risk.'

This really highlights the importance of being adaptable in financial arrangements to meet the needs of both parties.

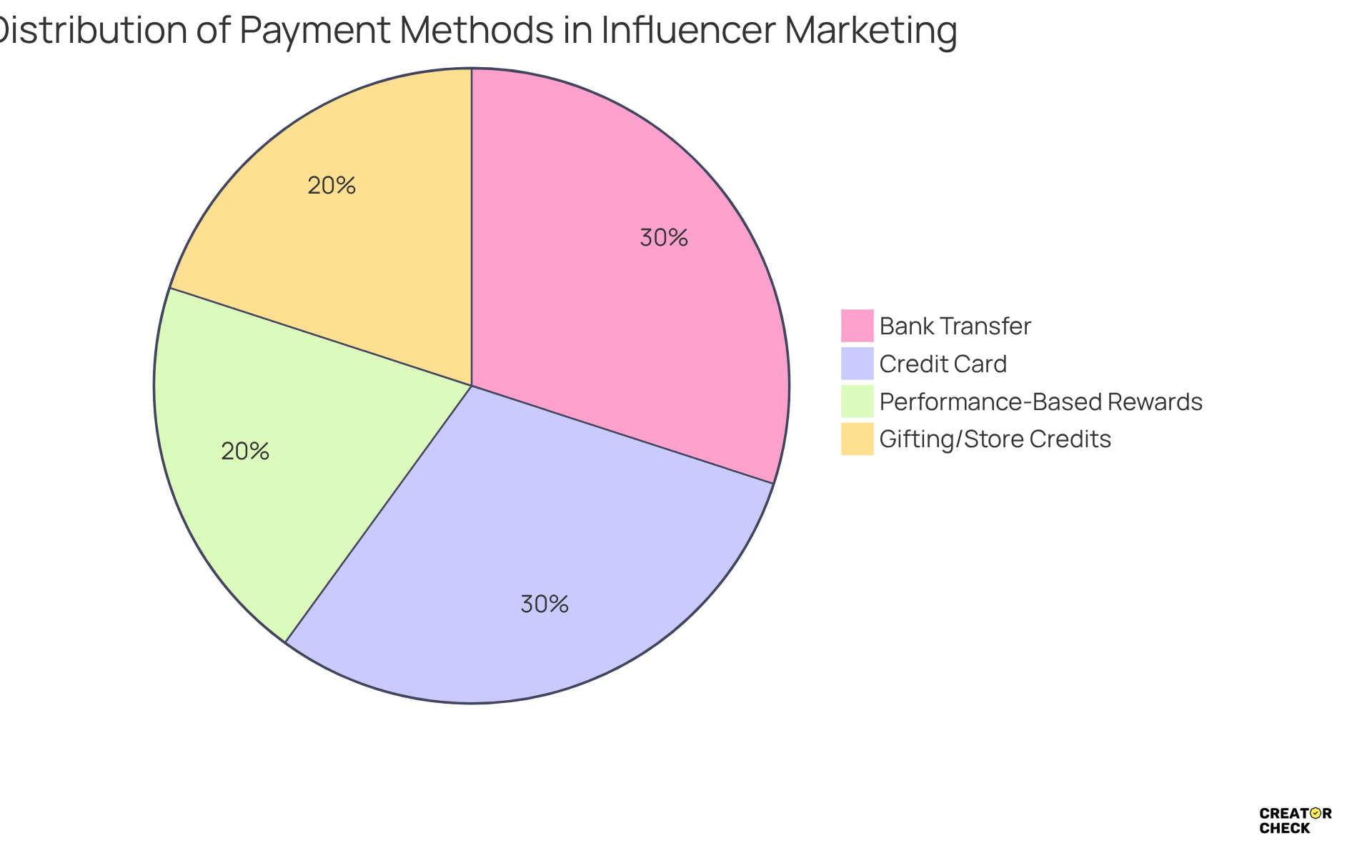

Payment Method Clause Template: Specifying Transaction Processes

A clearly outlined payment clause templates for agency contracts is essential in influencer marketing contracts. For example, you might see a clause that says: 'All transactions shall be made via bank transfer or credit card, with details to be provided in the invoice.' This kind of clarity helps both parties understand the acceptable methods of compensation, making transactions smoother.

Did you know that about 60% of marketers believe influencer marketing offers better ROI compared to other channels? This really highlights the need for effective compensation processes that can boost that ROI. Agencies often lean towards approaches that simplify transactions, like automated financial systems, which can significantly reduce onboarding and compliance workloads.

When it comes to acceptable compensation methods, think bank transfers, credit cards, and even performance-based rewards that incentivize influencers based on measurable outcomes. For instance, nano content creators might charge anywhere from $5 to $25 per post, while mega creators can rake in $2,500 or more per post. This shows just how much compensation methods can vary depending on the creator tiers. And while gifting and store credits might not be the go-to for larger influencers, they can work wonders for building long-term partnerships with smaller creators.

Understanding these preferences and using payment clause templates for agency contracts not only boosts operational efficiency but also builds trust and transparency in partnership agreements. As financial writer Brianna Blaney points out, 'Expect to pay anywhere from $10 to $1000 per post depending on the size of the influencer audience, the social media platform, and the type of marketing a successful influencer campaign does.' This insight really underscores the importance of clarity in financial methods to ensure successful collaborations. So, what does this mean for you? It’s all about creating those solid foundations for fruitful partnerships!

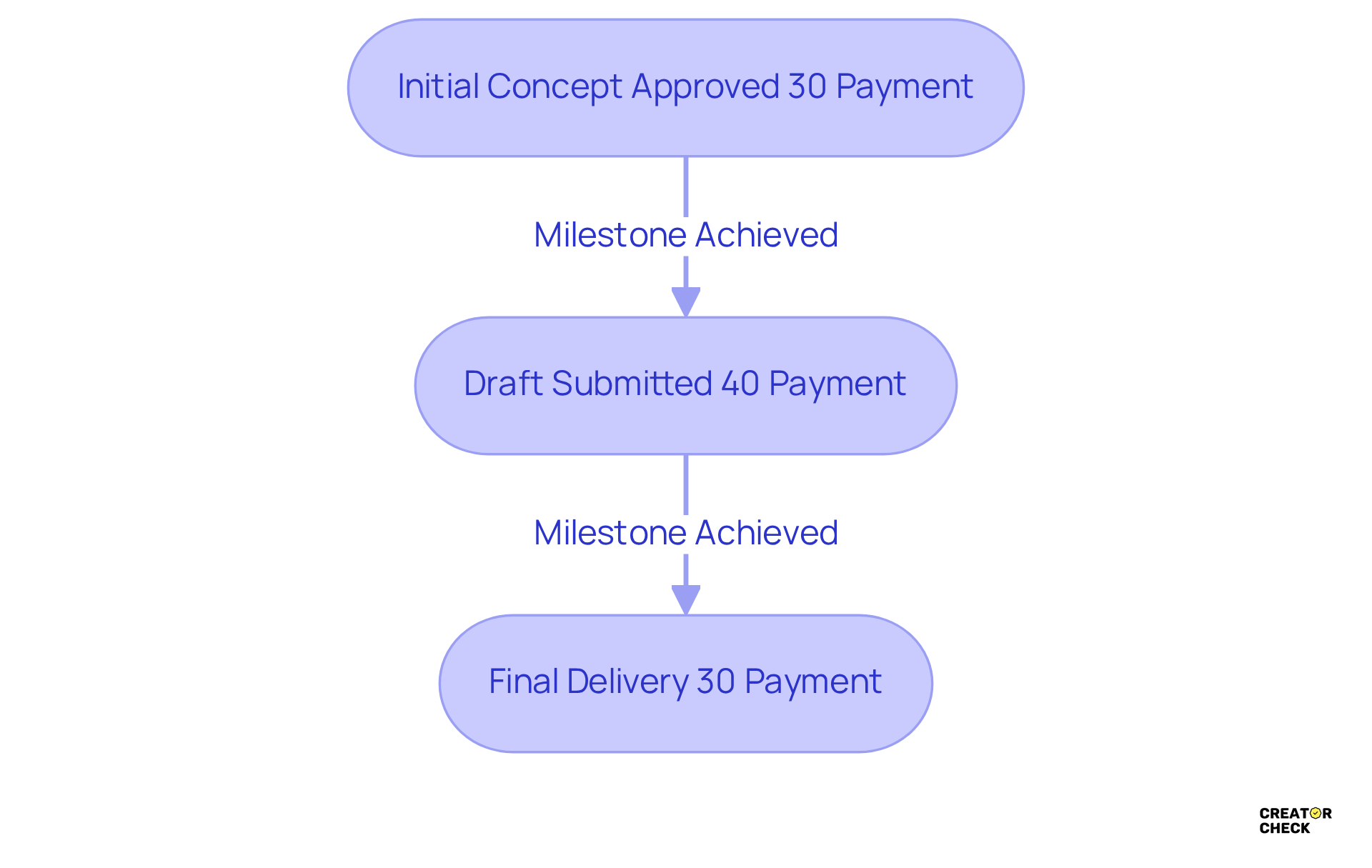

Milestone Payment Clause Template: Linking Payments to Deliverables

You might come across payment clause templates for agency contracts that include a milestone compensation provision, stating:

- 'Disbursements will happen when we hit certain milestones:

- 30% after we get the initial concept approved,

- 40% after the draft is submitted,

- and the final 30% after delivery.'

This kind of setup connects payments directly to what gets delivered, which is great because it keeps both parties motivated to hit those deadlines, particularly when utilizing payment clause templates for agency contracts.

So, how does this work for you? It’s all about ensuring everyone stays on track and excited about the project!

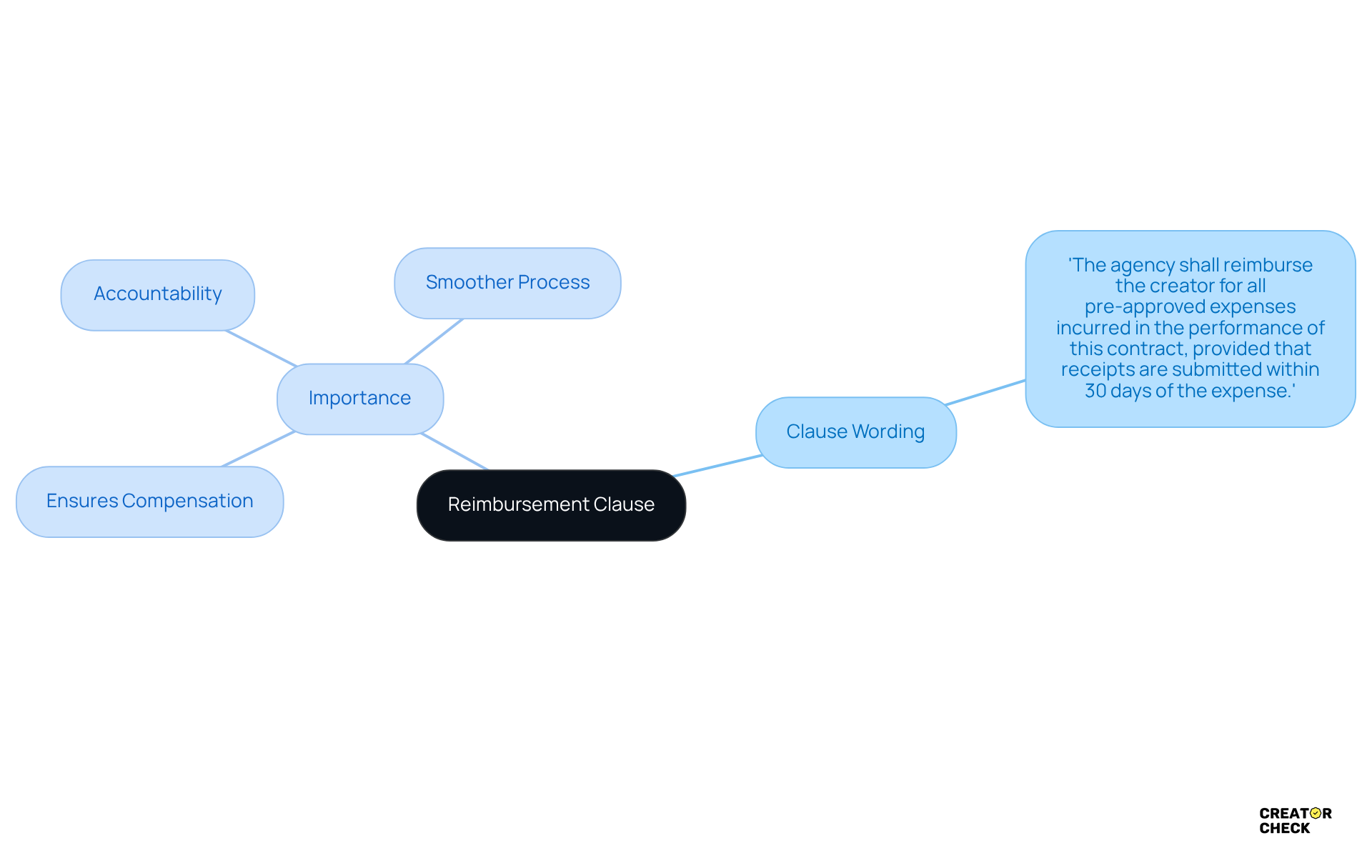

Reimbursement Clause Template: Managing Expense Claims

So, let’s talk about a reimbursement provision. It could say something like:

'The agency shall reimburse the creator for all pre-approved expenses incurred in the performance of this contract, provided that receipts are submitted within 30 days of the expense.'

This kind of provision is super important because it makes sure that creators get compensated for any out-of-pocket expenses they might have while keeping everything accountable. It’s all about making the process smoother for everyone involved!

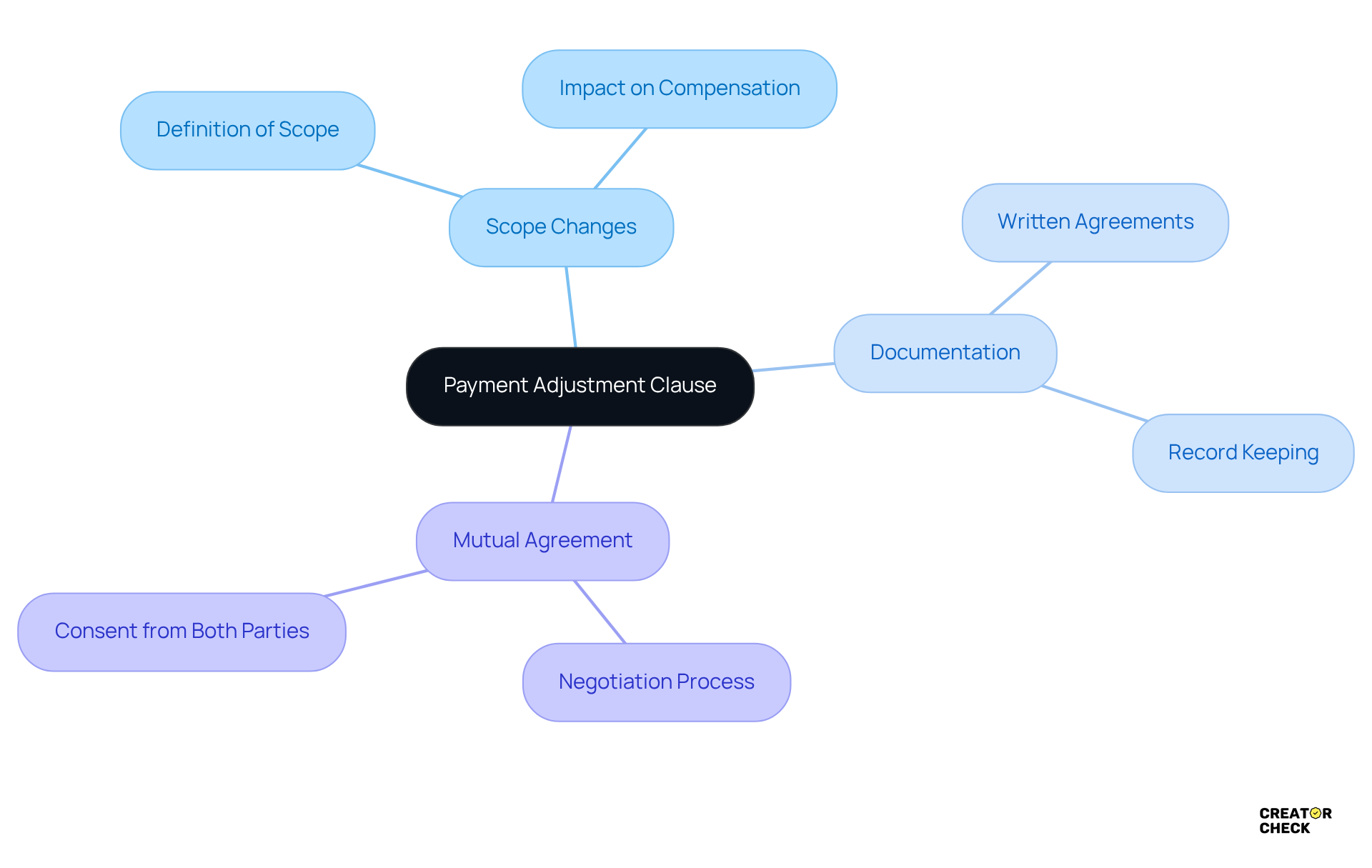

Payment Adjustment Clause Template: Addressing Scope Changes

Imagine this: a compensation adjustment provision might say something like, 'If the project scope changes, we'll adjust the amount accordingly, and both of us will agree to the new terms in writing.' This kind of provision is super important because it ensures that any changes are documented and accepted, keeping both parties' interests safe and sound.

So, how does this affect you? Well, it means you can move forward with confidence, knowing that any adjustments are handled fairly!

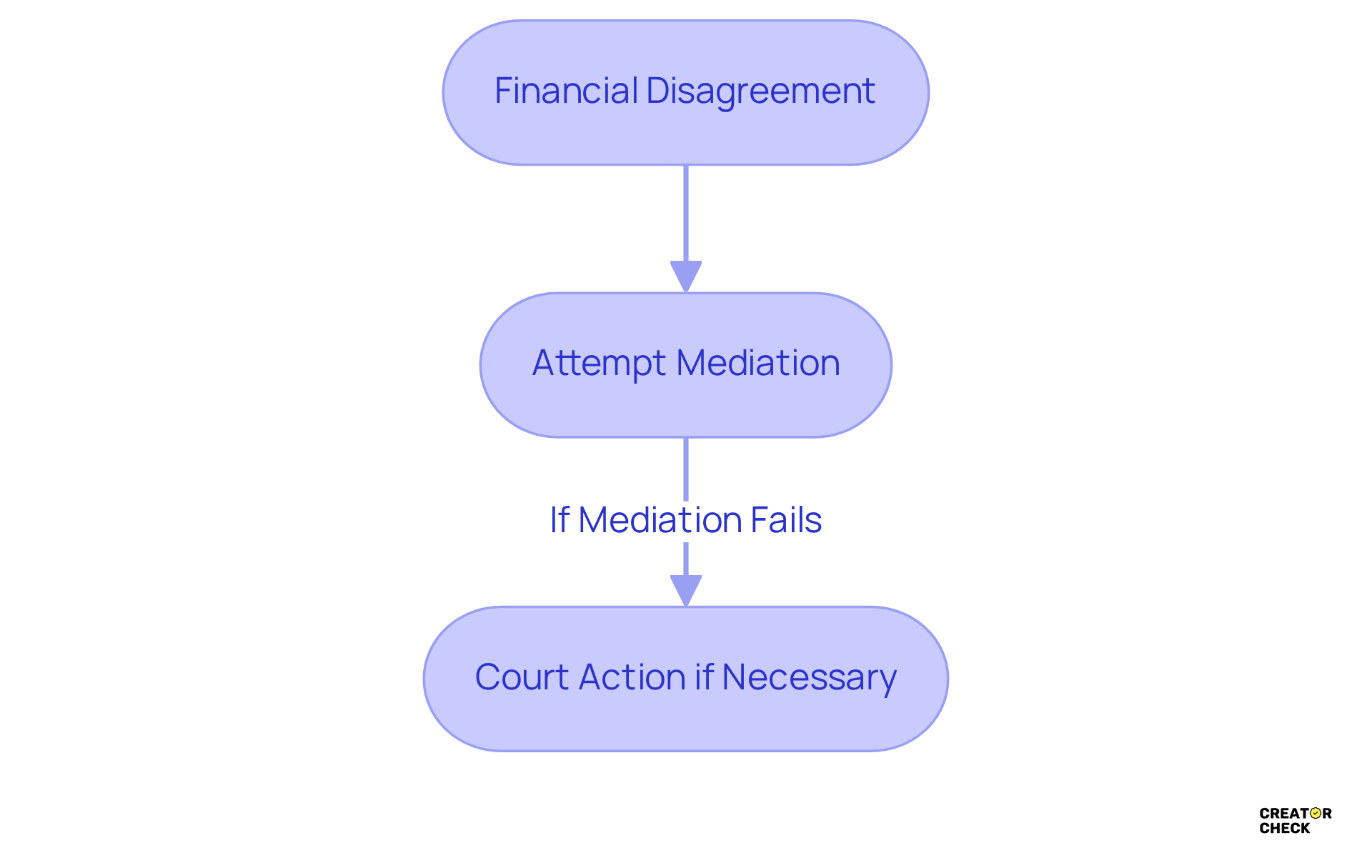

Payment Dispute Resolution Clause Template: Establishing Clear Processes

So, what’s the deal with resolving disputes over fees? How about this: In the case of a financial disagreement, both parties agree to try mediation before heading to court. This little clause sets up a straightforward way to tackle disputes, encouraging teamwork and helping to keep those legal costs down. It’s all about making things easier for everyone involved!

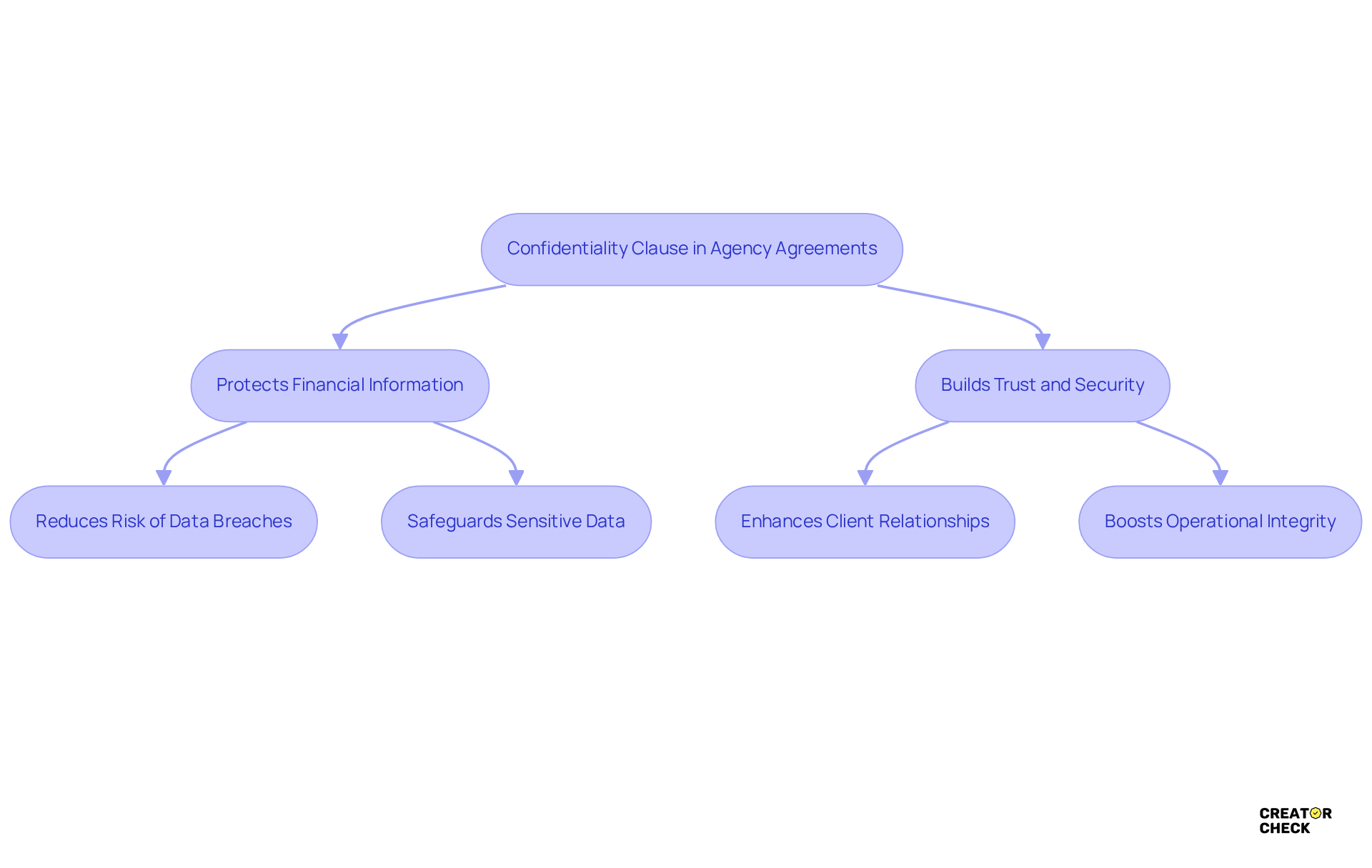

Confidentiality Clause Template: Protecting Payment Information

A confidentiality provision is super important in agency agreements because it makes sure both parties are on the same page about protecting sensitive financial information. For instance, a provision might say: 'Both parties agree to keep all financial information confidential and won’t share it with anyone outside without prior written approval.' This kind of provision not only safeguards financial data but also builds trust and security in the relationship.

Real-world examples really highlight why these provisions matter. In 2023, almost half of all data breaches involved customers' personal identifiable information, showing just how crucial it is to have strong confidentiality measures in place. Experts stress that protecting financial information in contracts is vital, as breaches can lead to hefty costs—averaging around $4.88 million in 2024. Plus, with 98% of organizations having at least one third-party vendor that has experienced a data breach, the risks just keep piling up. A solid confidentiality provision can help reduce these risks, keeping those sensitive payment details safe.

And get this: organizations typically take about 204 days to even recognize a breach and another 73 days to manage it. That really drives home the need for confidentiality agreements to help minimize risks. By adding these protective measures, influencer organizations can boost their operational integrity and keep client trust intact. So, what does this mean for you? It’s time to think about how you can strengthen your own agreements!

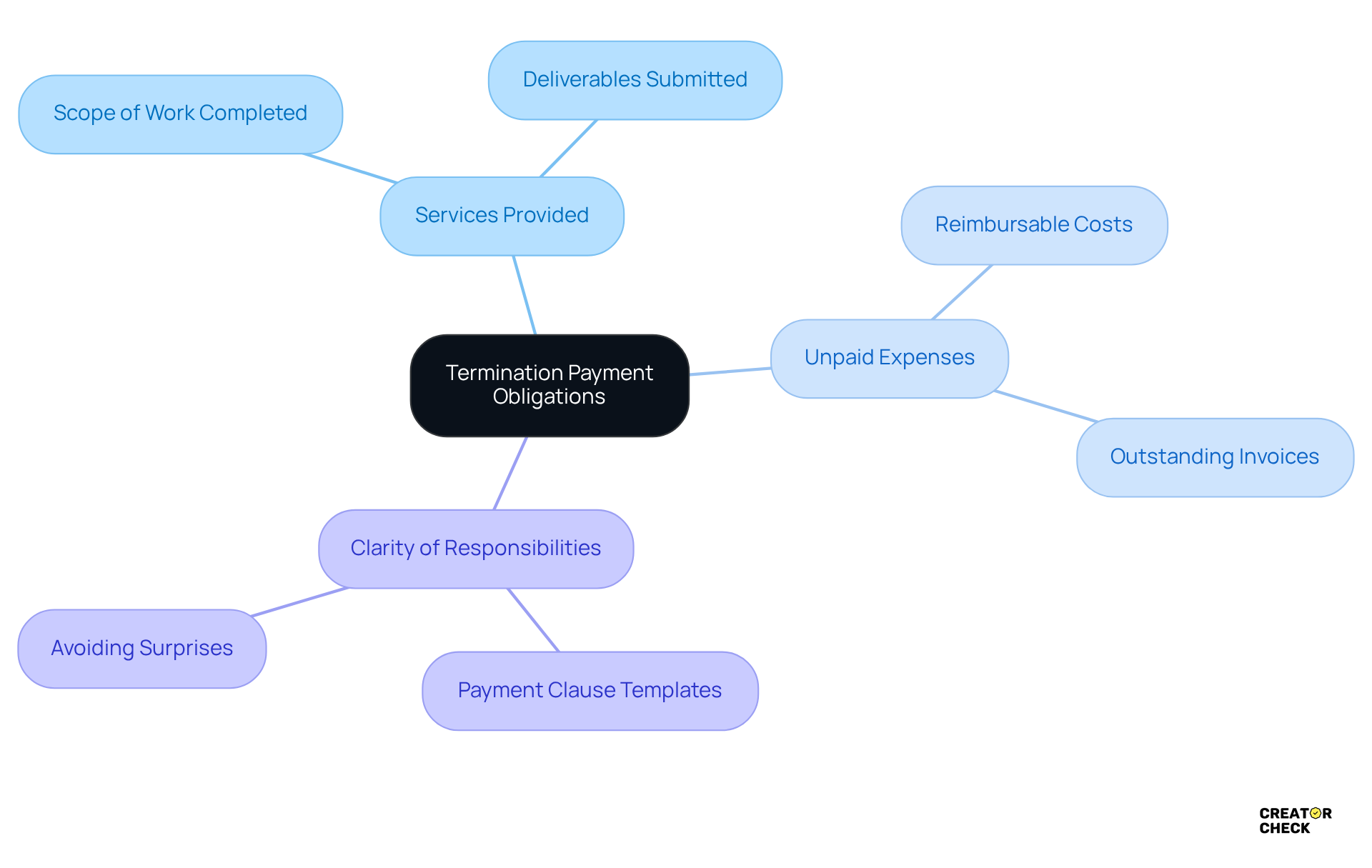

Termination Payment Clause Template: Defining Financial Obligations on Termination

So, what’s the deal with termination payments? Imagine this:

'Upon termination of this agreement, the agency shall compensate the creator for all services provided up to the termination date, including any unpaid expenses, in accordance with the payment clause templates for agency contracts.'

This payment clause templates for agency contracts really help to clarify the financial responsibilities for both parties. It’s all about making sure that when it’s time to part ways, everything goes smoothly. After all, nobody wants any surprises at the end, right?

Conclusion

Integrating essential payment clause templates into agency contracts is super important for building transparency, efficiency, and trust between agencies and creators. By using these templates, organizations can streamline their financial management processes, ensuring timely payments and cutting down on potential disputes. Just think about the automated payment systems, like those from Creator Check, which show how technology can really shake things up in the world of financial transactions in influencer marketing.

Throughout this article, we've highlighted various payment clause templates, including:

- Late payment penalties

- Payment schedules

- Reimbursement provisions

- Confidentiality agreements

Each of these templates plays a key role in tackling specific concerns within agency contracts, from ensuring timely payments to safeguarding sensitive financial information. Plus, the discussion around milestone payments and payment adjustments really highlights the need for flexibility and clarity in financial arrangements, which ultimately boosts operational efficiency and creator satisfaction.

As the influencer marketing industry keeps growing, adopting standardized payment practices is becoming more crucial than ever. Agencies are encouraged to implement these payment clause templates not just to protect their interests but also to help creators achieve financial stability. By prioritizing clear communication and well-defined financial terms, agencies can forge stronger partnerships that benefit everyone involved, paving the way for a more sustainable and prosperous marketing ecosystem. So, what does this mean for you? It’s time to embrace these practices for a smoother, more successful journey ahead!

Frequently Asked Questions

What is Creator Check?

Creator Check is an AI-powered payment management system designed to automate invoice handling and track disbursements, allowing agencies to process about 80% of transactions upfront, similar to a bi-weekly payroll system.

How does Creator Check benefit agencies and creators?

Creator Check improves efficiency by reducing administrative tasks, enabling agencies to focus on building relationships with creators while ensuring timely payments. Quick transactions are crucial in the influencer world, as they encourage influencers to engage in partnerships.

What issues do agencies face with payment processing?

Agencies can experience delays in transactions due to regulatory requirements, which can extend processing times beyond 60 days for domestic creators and up to 30 days for global creators.

What is a late payment penalty clause?

A late payment penalty clause is a provision that imposes a fee on overdue payments, such as a 1.5% charge per month after 30 days of the invoice date, to encourage timely payments and maintain cash flow.

Why are late payment penalties important in influencer marketing?

With the influencer marketing industry valued at $250 billion and projected to grow significantly, implementing late payment penalties helps ensure creators are paid on time, addressing the financial pressure caused by delayed payments.

What is the significance of payment schedule clauses in contracts?

Payment schedule clauses clearly outline when payments are due, such as 50% upon signing and the rest based on milestones, which helps manage expectations and aligns incentives between brands and creators.

How can tiered compensation structures enhance project execution?

Tiered compensation structures, like advance fees followed by milestone payments, reduce risks associated with incomplete deliverables and enhance accountability in financial transactions.

What best practices can agencies implement to manage overdue invoices?

Agencies can integrate automated reminders and define escalation paths for overdue invoices to improve their legal stance in case of disputes and ensure timely payments.

How do compensation timelines vary among creators?

Micro creators typically accept lower fees with performance bonuses, while macro creators often demand larger guarantees, highlighting the need for tailored compensation schedules based on the creator type.

What overall benefits do payment clause templates provide for agency contracts?

Payment clause templates streamline operations, foster collaboration between agencies and creators, improve campaign ROI, and reduce reconciliation errors by clearly defining payment expectations and timelines.