Overview

The article titled "9 Payment Term Red Flags Decoded for Influencer Agencies" is all about spotting and tackling those pesky issues that can mess up payment processes between influencer agencies and content creators. It points out that:

- Vague payment terms

- Late payments

- Sneaky hidden fees

can really strain relationships and leave everyone feeling unsatisfied.

So, what’s the takeaway?

Clear communication, timely payments, and secure transaction methods are key to building trust and keeping things running smoothly. Remember, a little transparency goes a long way in fostering good vibes and operational efficiency!

Introduction

Navigating the intricate landscape of influencer marketing can often feel like walking a tightrope, right? With payment term red flags lurking at every turn, it’s no wonder agencies are on high alert. For those striving to maintain strong relationships with content creators, understanding these potential pitfalls is crucial.

Let’s dive into the key warning signs that can jeopardize partnerships and explore how to identify and address common payment issues. What strategies can agencies implement to foster trust and ensure smooth financial transactions in an industry where clarity and reliability are paramount?

It’s all about creating that solid foundation, don’t you think?

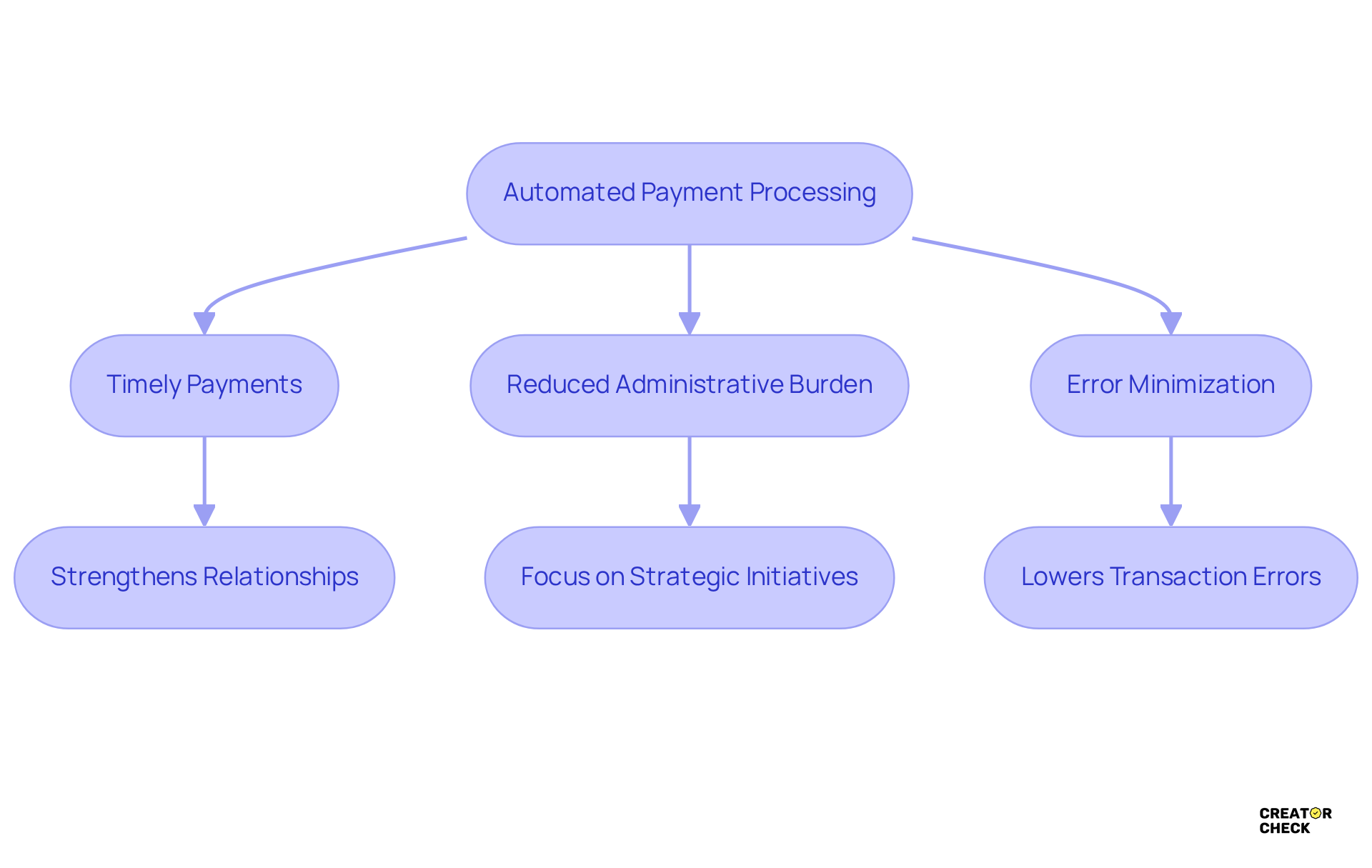

Creator Check: Automated Payment Processing to Prevent Delays

Creator Check's automated transaction processing capability is designed to tackle the pesky delays that often trip up influencer firms. By fine-tuning invoicing and transaction processes, agencies can ensure that content creators get their earnings right on time—something that's key to building trust and satisfaction. This system not only saves precious time but also significantly cuts down on the chance of human errors that can lead to transaction discrepancies. As reported by F**k You Pay Me, the payment term red flags decoded indicate that payment delays are a major reason content creators leave certain platforms or brand partnerships. With this technology, agencies can pivot their focus from the nitty-gritty of admin tasks to driving strategic growth, ultimately boosting their bottom line.

Key Benefits:

- Timely Payments: Ensures creators are paid on schedule, which strengthens those all-important positive relationships.

- Reduced Administrative Burden: Frees up agency resources to be directed toward more strategic initiatives.

- Error Minimization: Lowers the chances of transaction errors that could spark disputes.

The move toward automated invoicing is increasingly being recognized as essential, with a whopping 77% of brands seeing automation as a must-have in their marketing strategies. As Laura Donadio from Wild puts it, "Performance-based structures allow us to push toward real results like sales, rather than just impressions." This shift not only streamlines transaction processes for artists but also helps firms thrive in a competitive landscape where effectiveness and reliability are crucial. So, what does this mean for you? It’s a game-changer!

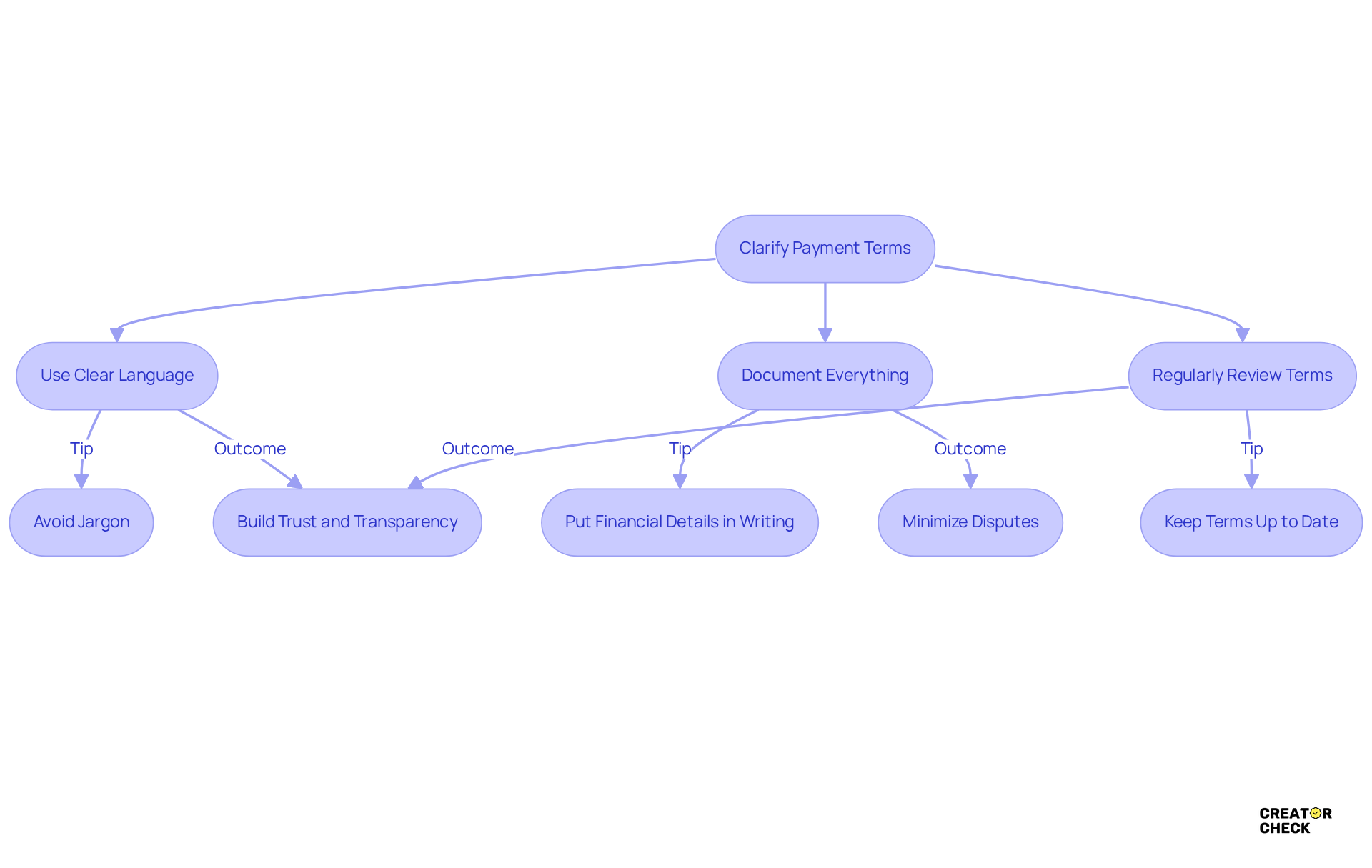

Ambiguous Payment Terms: Clarify to Avoid Misunderstandings

Unclear financial terms can lead to situations where payment term red flags decoded cause confusion and disagreements between influencer agencies and creators. To avoid any misunderstandings, it’s super important to clearly lay out amounts, due dates, and methods of compensation in contracts, as this helps in payment term red flags decoded. Agencies should make sure everyone is on the same page before any work kicks off. This proactive approach not only helps dodge conflicts but also builds trust and transparency in the relationship. And let’s not forget, contracts with Net-60 or Net-90 terms can mean waiting anywhere from 90 to 180 days for funds to clear, which really emphasizes the importance of payment term red flags decoded for clarity.

Industry leaders are all about promoting transparent compensation structures. Take Sam Royle from SoSquared, for example—he highlights how effective hybrid compensation models can be. By combining upfront fees with performance incentives, these models align compensation with results and help minimize disputes. By adopting these best practices, agencies can boost their operational efficiency and maintain positive relationships with creators, which is essential for payment term red flags decoded, leading to smoother campaign execution and better financial outcomes.

So, what can you do to make sure everything runs smoothly? Here are a few best practices to keep in mind:

- Use Clear Language: Ditch the jargon and make sure everything is easy to understand.

- Document Everything: Put all financial details in writing to have a solid reference point.

- Regularly Review Terms: Keep financial terms up to date to reflect any changes in business practices or market conditions.

By following these tips, you can create a more transparent and effective working relationship that benefits everyone involved!

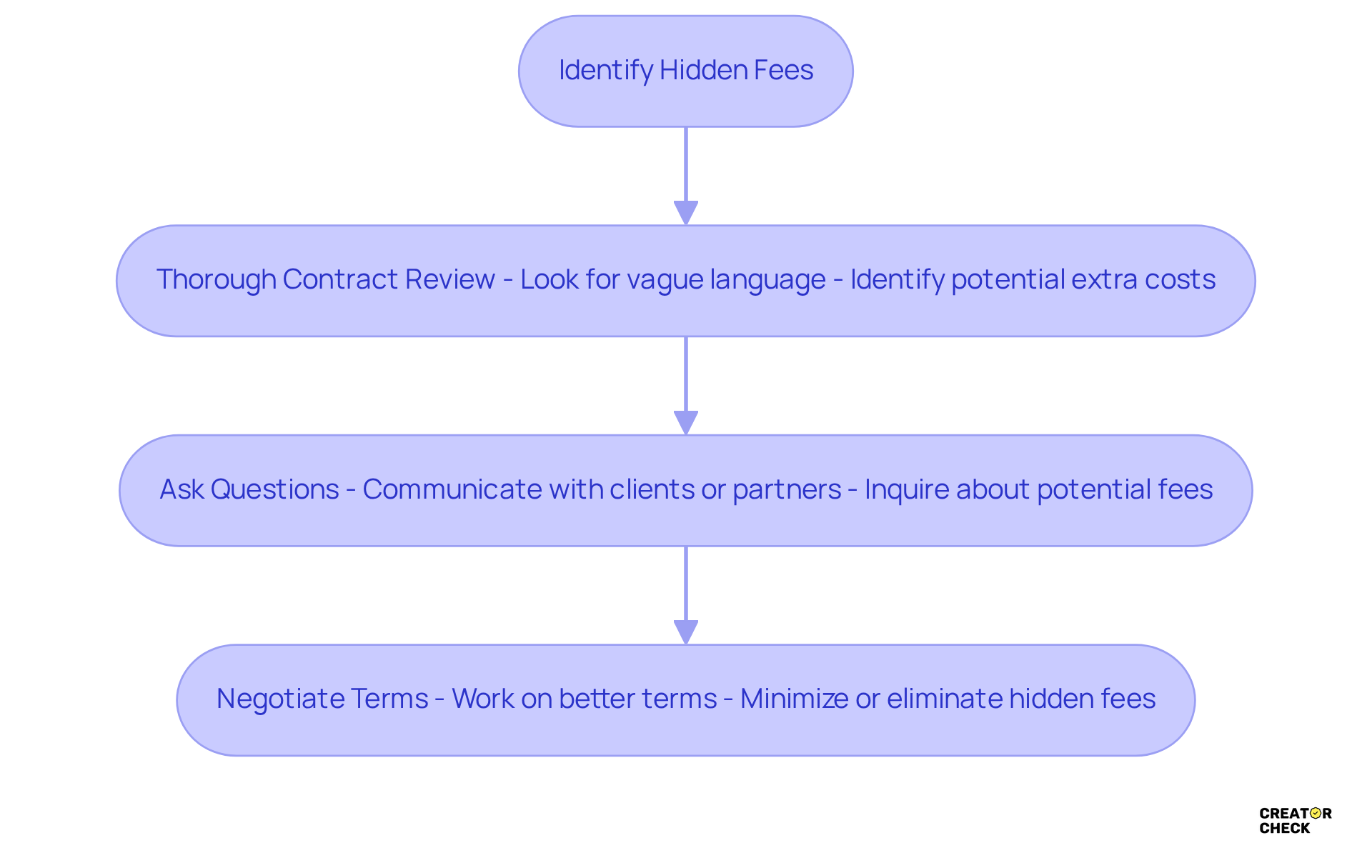

Hidden Fees: Identify and Negotiate to Protect Margins

Hidden fees can sneak in and quietly eat away at the profits of influencer firms. That’s why it’s super important to spot and negotiate these costs right from the get-go. Agencies should take the time to thoroughly evaluate contracts and financial arrangements to uncover any hidden charges that might not be obvious at first glance. By chatting about these fees, organizations can protect their margins and ensure they’re not paying more than they should for services.

So, how can you identify those pesky hidden fees? Here are a few strategies to consider:

- Thorough Contract Review: Take a close look at contracts for any vague language that might hint at extra costs.

- Ask Questions: Don’t be shy! Reach out to clients or partners and ask about any potential fees that could pop up.

- Negotiate Terms: Work on negotiating better terms that can help minimize or even eliminate those hidden fees.

Let’s dive into these strategies and see how they can make a difference for you!

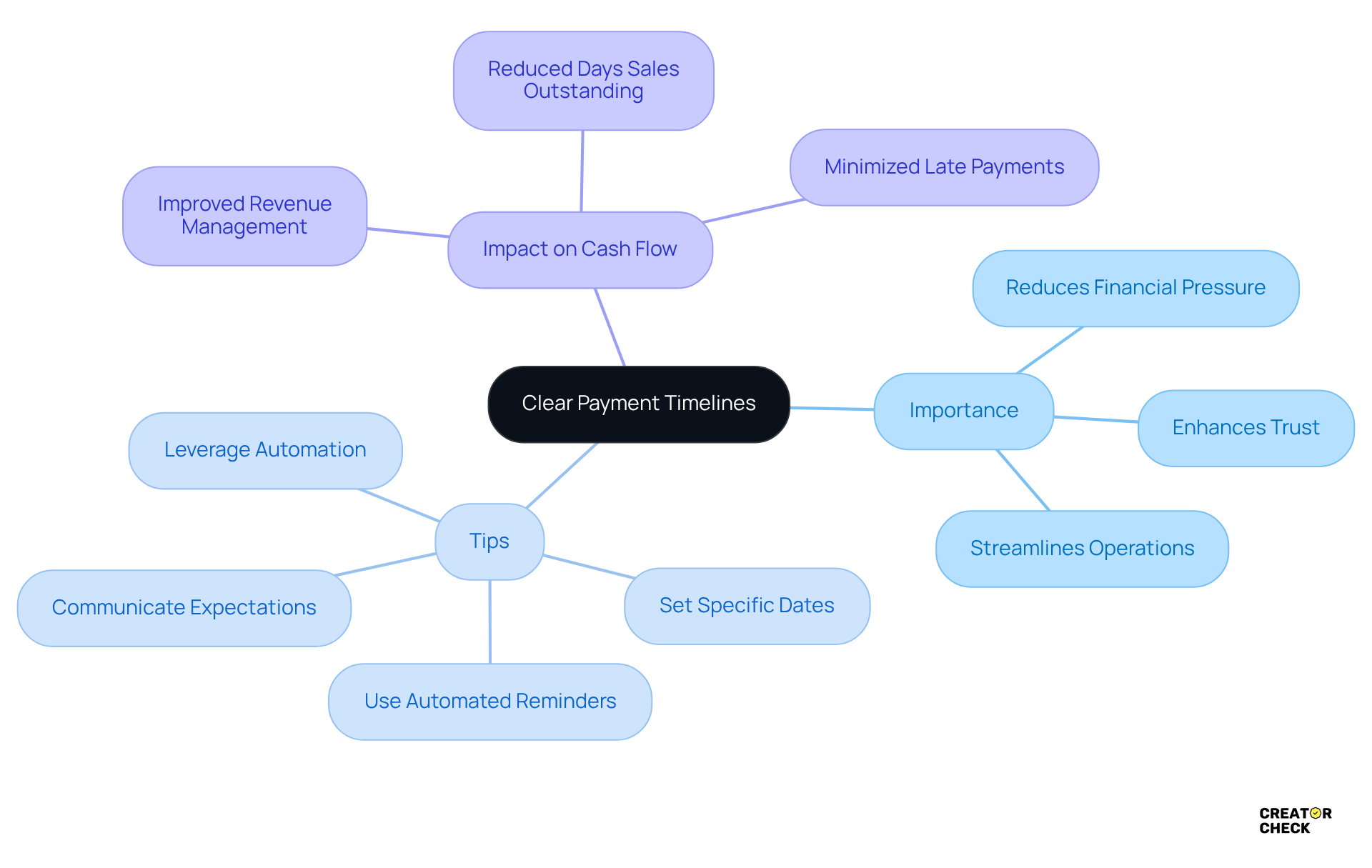

Unclear Payment Timelines: Establish Clear Schedules to Ensure Cash Flow

Ambiguous financial schedules can really throw a wrench in the cash flow for influencer firms, which is why it's essential to understand payment term red flags decoded. That's why creating clear financial schedules is super important. It helps specify when payments are due and how long processing might take. This clarity allows agencies to manage their finances effectively, ensuring they can cover operational costs without any hiccups.

Tips for Establishing Clear Payment Timelines:

- Set Specific Dates: Clearly define payment due dates in contracts to avoid any confusion.

- Communicate Expectations: Keep creators in the loop about compensation timelines to align expectations and build trust.

- Use Automated Reminders: Implement systems that send notifications for upcoming dues, helping everyone stay on track.

- Leverage Automation: Use automated accounts receivable processes to streamline transaction management and boost cash flow efficiency.

Now, let’s talk about why managing cash flow in promotional marketing is so crucial. Organizations that prioritize transparent billing timelines can significantly reduce the risk of delayed transactions by addressing payment term red flags decoded. According to industry data, these delays can put significant financial pressure on firms. As industry leaders have pointed out, effective financial structures, along with payment term red flags decoded, are key elements that streamline execution and reduce risks, ultimately enhancing the success of influencer collaborations. For instance, 55% of companies expect Days Sales Outstanding (DSO) to increase in 2024, highlighting the need for efficient revenue management. And as Rocky Bello said, "Creator Check is a vital tool for those seeking to improve their operational efficiency," which underscores the importance of having organized financial processes.

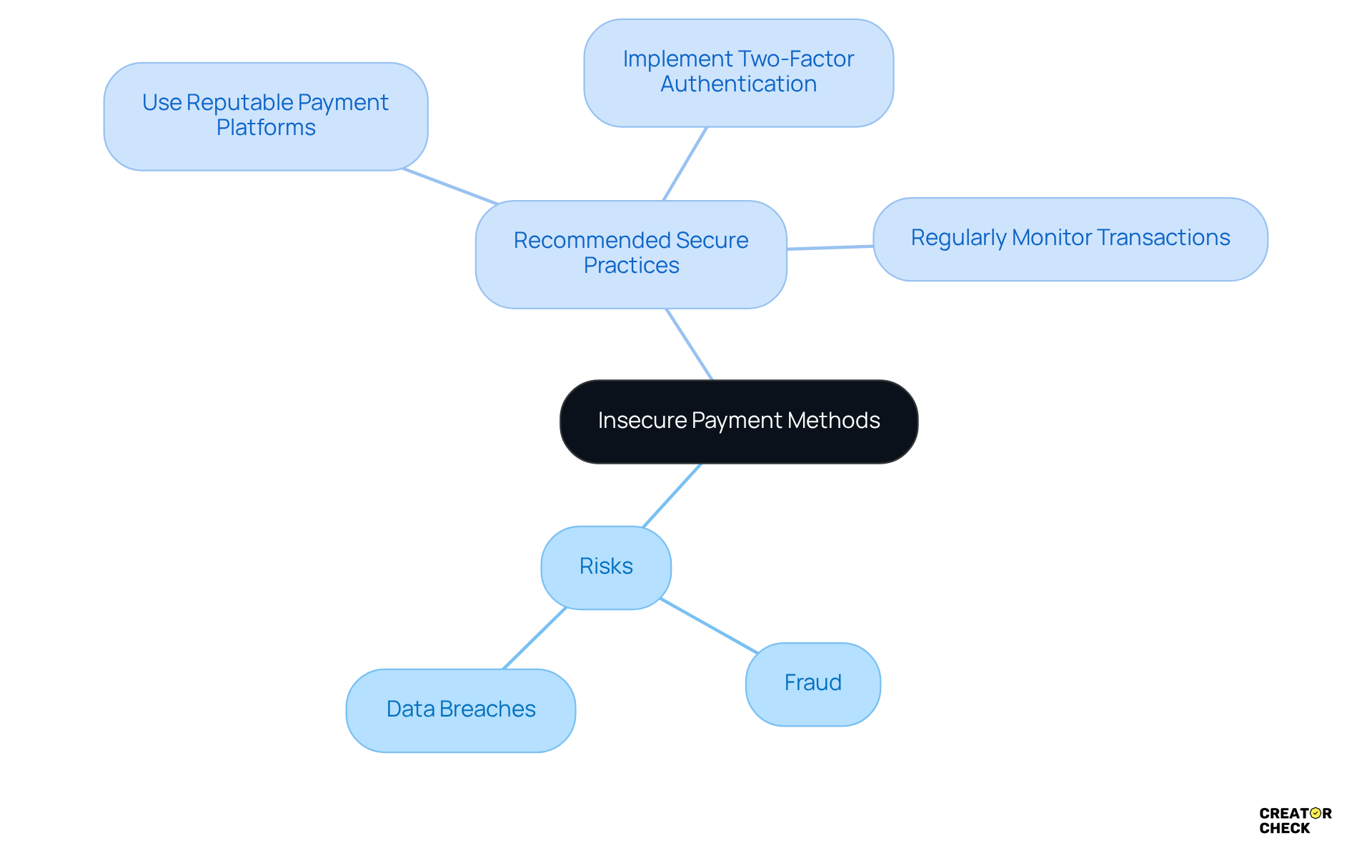

Insecure Payment Methods: Prioritize Security to Mitigate Fraud Risks

Unreliable transaction methods can really put influencer firms at risk, exposing them to dangers like fraud and data breaches. So, how can organizations tackle these threats? By prioritizing secure financial systems that come packed with advanced security features like encryption, SSL certificates, and real-time fraud detection. Plus, compliance with the Payment Card Industry Data Security Standard (PCI DSS) is a must for businesses handling credit card transactions. When agencies adopt secure transaction methods, they not only protect sensitive financial information but also build trust with their creators—something that's crucial for long-term partnerships.

Recommended Secure Payment Practices:

- Use Reputable Payment Platforms: Go for payment processors known for their strong security measures.

- Implement Two-Factor Authentication: Add an extra layer of security for your transaction processes.

- Regularly Monitor Transactions: Keep an eye on transaction activity to spot any suspicious behavior.

These practices are super important, especially considering that around 50 million people are part of the content production economy. As things evolve, organizations need to stay sharp against fraud threats, ensuring their transaction processes are not just effective but also safe. High-profile data breaches have shown us just how vital it is to keep security protocols tight—lax measures can lead to hefty financial losses and a tarnished reputation. By investing in secure transaction methods, organizations can boost their operational integrity and build lasting trust with their contributors. As Anton Kornilov pointed out, "Eight in ten individuals who produce content earn income by utilizing various revenue sources to establish financial stability," highlighting just how crucial dependable payment systems are for supporting producers' financial well-being.

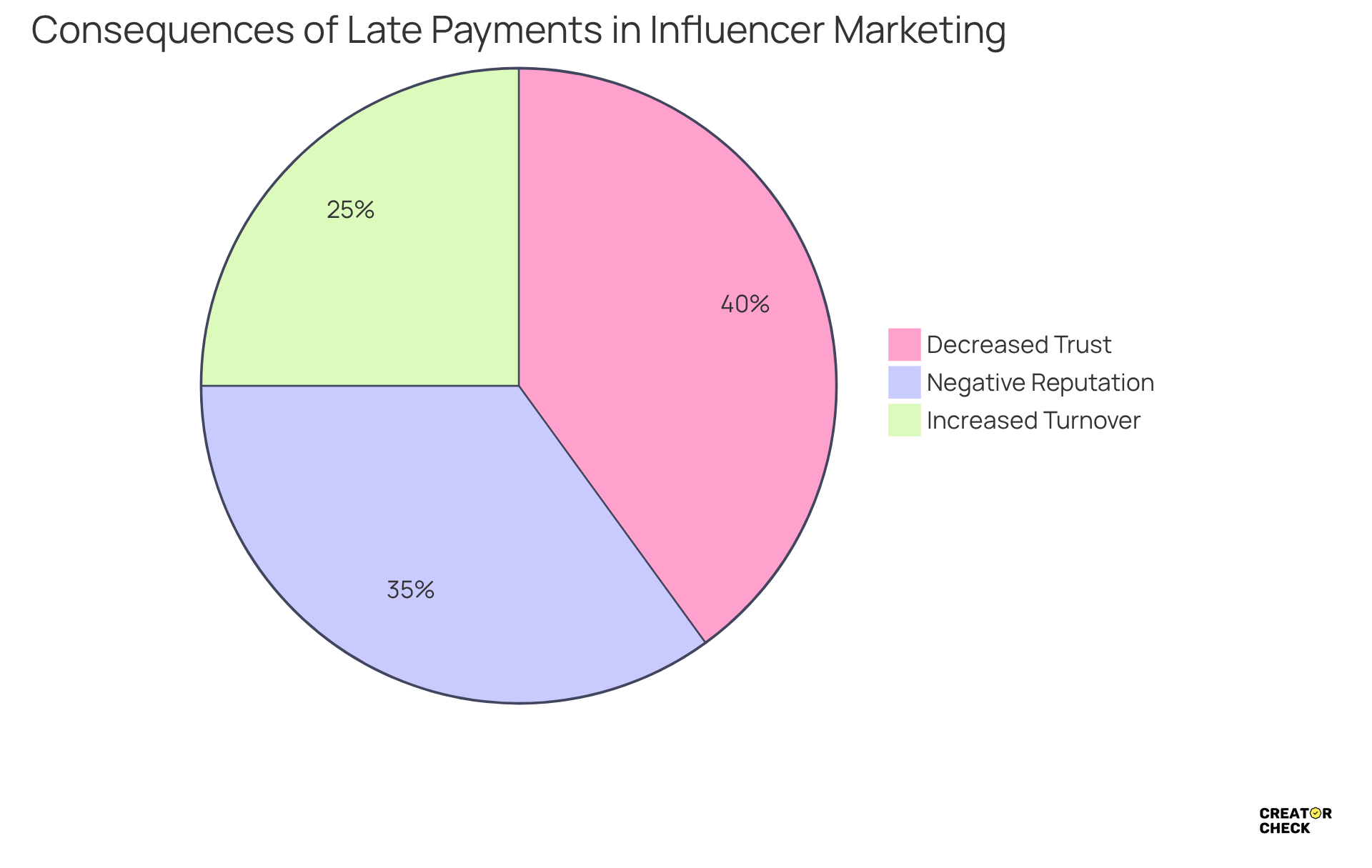

Late Payments: Recognize Consequences on Agency Relationships

Delayed payments can really strain the relationships between influencer agencies and content creators, leading to frustration and distrust. Agencies need to be aware of the fallout from late payments, which can damage reputations and make contributors less willing to team up in the future. To keep those collaborations thriving, it’s essential for organizations to prioritize timely payments and stay in touch with creators about any potential delays.

So, what does this mean for you? Here are some consequences of late payments:

- Decreased Trust: Creators might hesitate to work together again, worried about facing similar issues down the line.

- Negative Reputation: Agencies risk tarnishing their reputation in the industry, as word of delayed payments can spread quickly among creators. In fact, 40% of influencer marketers struggle with making timely payments to influencers, highlighting just how common this issue is.

- Increased Turnover: Creators are likely to seek out agencies that prioritize prompt payment, which can lead to higher turnover rates for those that don’t focus on this important aspect.

Industry leaders stress the importance of maintaining strong relationships through timely transactions. For instance, Kendall Gall, a talent manager, has pointed out the challenges that arise when brands go unresponsive, despite multiple reminders for payment. She noted, "Despite her diligence—sending reminders before and after the due date and escalating to weekly legal demands—the brand has remained unresponsive." These experiences underline the need for organizations to align their financial practices with the expectations of content creators, particularly by understanding payment term red flags decoded to foster a collaborative atmosphere that encourages ongoing partnerships. Plus, it’s worth mentioning that the official payment cycle often kicks in after 90 days post-campaign execution, which can lead to those pesky late payments.

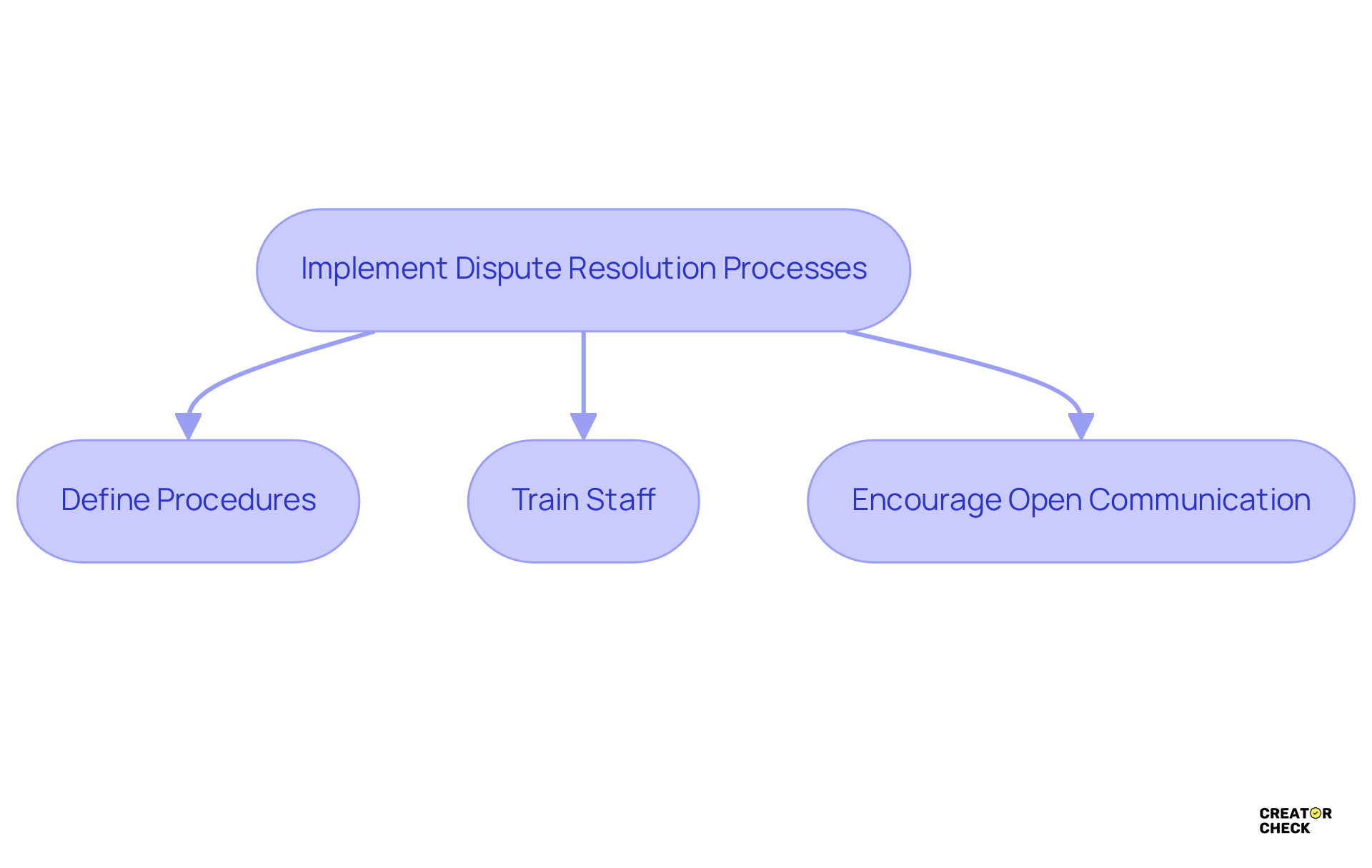

Lack of Dispute Resolution: Implement Processes to Resolve Conflicts

Without clear dispute resolution processes, conflicts can really escalate and strain relationships between influencer firms and individuals. So, what can agencies do? They should definitely implement straightforward procedures for resolving disputes, including options like mediation and arbitration. By putting these processes in place, organizations can tackle conflicts effectively and keep those constructive working relationships intact.

Let’s dive into some steps you can take to implement these dispute resolution processes:

- Define Procedures: Clearly outline the steps for resolving disputes in contracts.

- Train Staff: Make sure your team members are trained in conflict resolution techniques.

- Encourage Open Communication: Foster an environment where everyone feels comfortable discussing issues.

By taking these steps, you not only resolve conflicts but also create a more positive atmosphere for everyone involved!

Vague Contract Language: Ensure Clarity to Avoid Disputes

Ambiguous contract wording can create uncertainty and lead to conflicts between marketing firms and creators. To avoid this, organizations should ensure that all contract terms are clearly outlined. This clarity helps set expectations and lowers the chances of misunderstandings that can lead to disputes.

So, how can you make your contracts clearer? Here are a few tips:

- Use Simple Language: Ditch the legal jargon and complex terms that might leave everyone scratching their heads.

- Define Key Terms: Make sure to clearly define any terms that could be interpreted in different ways.

- Review Contracts Regularly: Keep your contracts fresh by reviewing and updating them to maintain clarity and relevance.

- Incorporate Case Studies: Take, for example, the Adidas Yeezy brand deal termination. It underscores the importance of reputation clauses in agreements with promoters, showing how precise contract language can prevent conflicts and protect the organization’s interests.

- Utilize Quotes: As Mark Knight puts it, "Clear compensation terms are crucial to ensure fair remuneration," which really highlights how vital clarity is in contracts.

- Mention Statistics: With the ASEAN marketing sector expected to hit $2.59 billion by 2024, having clear contracts is even more critical as firms navigate this competitive landscape.

- Highlight Creator Check's Role: Creator Check's features, like automated payment processing and AI negotiation, help clarify contract terms and reduce misunderstandings, boosting operational efficiency for marketing firms.

Industry leaders agree that well-drafted contracts can prevent complications and promote smoother relationships. By focusing on clarity in contracts, influencer firms can enhance their operational efficiency and protect their interests. So, what steps will you take to ensure your contracts are crystal clear?

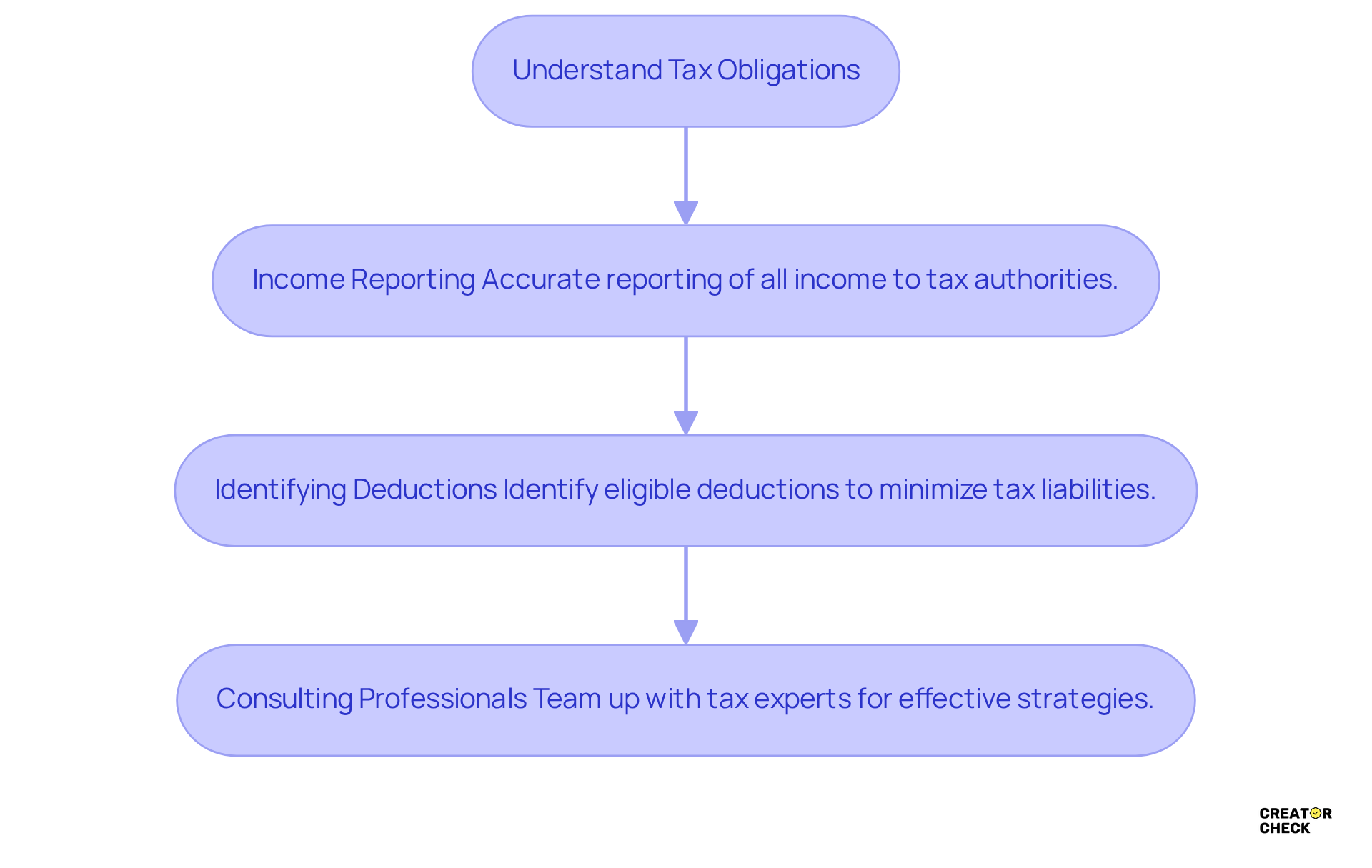

Tax Implications: Understand Obligations to Maintain Profitability

Influencer firms really need to navigate the tricky world of tax obligations if they want to stay profitable and on the right side of the law. It’s super important to understand how to report income, manage deductions, and stick to tax regulations for effective financial management. By staying informed about these responsibilities, organizations can dodge penalties and boost their financial strategies.

So, what are the key tax considerations?

- Income Reporting: First off, accurate reporting of all income to tax authorities is essential. If influencers are earning over £1,000 a year, they must register with HMRC to comply with tax laws. This registration is a crucial step for organizations to steer clear of legal troubles and maintain financial health.

- Deductions: Next, let’s talk about deductions. Identifying eligible deductions can really help minimize tax liabilities. This includes expenses related to influencer partnerships, like promotional costs and operational expenses. Knowing what counts as a deductible expense is key to maximizing profitability.

- Consult Professionals: And don’t forget about the pros! Teaming up with tax experts can help organizations navigate those complex regulations. Experts like Ricky Nagano highlight the importance of grasping corporate tax fundamentals to avoid pitfalls and improve financial outcomes. Consulting with experts can lead to more effective tax strategies tailored to the organization's unique needs.

Managing tax obligations effectively not only shields against legal issues but also boosts profitability. For example, organizations that keep detailed records of income from brand partnerships, affiliate marketing, and sponsored posts can streamline their reporting processes, leading to better financial health. By tapping into insights from tax experts and learning from case studies—like those on affiliate marketing and sponsored posts—firms can craft proactive tax strategies that align with their operational goals.

So, how are you managing your tax obligations? Remember, staying informed and proactive can make all the difference!

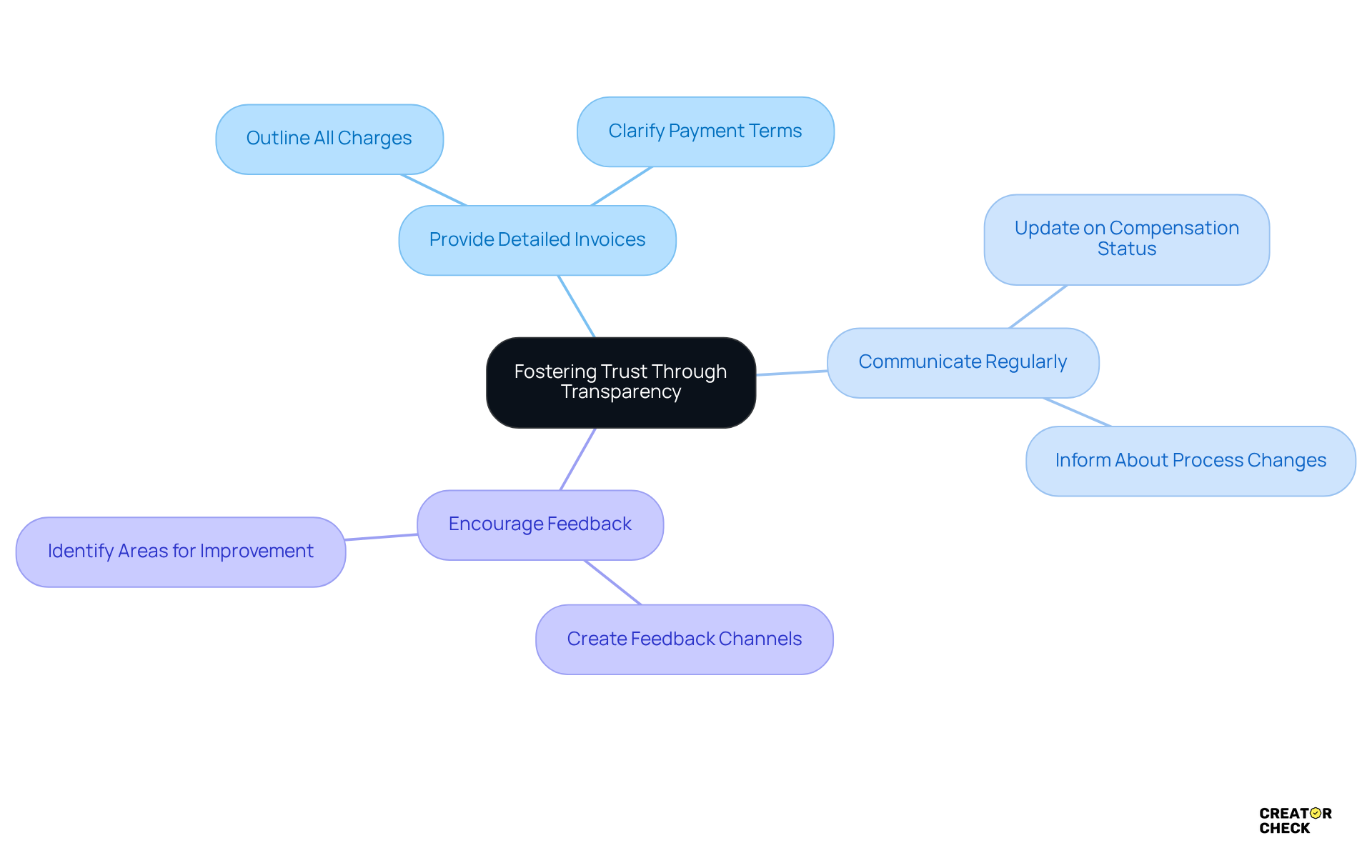

Lack of Transparency: Foster Trust Through Clear Payment Processes

When financial processes lack clarity, it can really shake the trust between influencer firms and content creators. To build a solid foundation of trust, organizations need to establish clear payment practices that include payment term red flags decoded, detailing how payments are calculated, when distributions occur, and any associated fees. By sharing this information upfront, agencies can strengthen their relationships with content producers, leading to better collaboration and overall satisfaction.

Did you know that 60% of marketers say influencer-generated content outperforms brand-directed content? This highlights just how important it is to nurture positive connections with contributors.

So, what can you do to foster transparency? Here are a few strategies:

- Provide Detailed Invoices: Make sure invoices clearly outline all charges and payment terms, leaving no room for confusion.

- Communicate Regularly: Keep contributors in the loop about compensation statuses and any changes to processes, reinforcing that sense of partnership.

- Encourage Feedback: Create ways for creators to share their thoughts on compensation processes, helping firms identify areas for improvement and adjust as necessary.

Implementing these strategies not only builds trust but also positions organizations as reliable partners in the influencer marketing landscape, where understanding payment term red flags decoded is increasingly valued. As Zig Ziglar wisely said, "Creating a brand that piques consumers' interest allows you to engage with them. Add brand trust to the equation; you have the key to their hearts." Plus, tools like Creator Check can simplify these payment processes, ensuring that agencies manage payments efficiently and transparently.

Conclusion

Establishing effective payment practices is super important for influencer agencies if they want to keep positive relationships with creators. By spotting and addressing payment term red flags, agencies can really boost their operational efficiency and build trust. The insights shared here highlight how crucial timely payments, clear communication, and secure transaction methods are—all essential for creating a reliable and collaborative environment.

So, what are the key takeaways? The article emphasizes the need to:

- Automate payment processes to avoid delays.

- Clarify any ambiguous terms to steer clear of misunderstandings.

- Identify those pesky hidden fees that could eat into profit margins.

- Set clear payment timelines.

- Use secure payment methods.

- Have strong dispute resolution processes.

These are vital strategies that can help reduce risks and improve the overall experience for both agencies and creators.

Ultimately, prioritizing transparent payment practices not only protects the financial interests of influencer agencies but also fosters a sense of partnership with creators. As the influencer marketing landscape keeps evolving, agencies are encouraged to embrace these best practices to ensure smooth transactions and long-lasting collaborations. By focusing on clarity and reliability in payment processes, agencies can not only enhance their reputation but also contribute to the success of influencer campaigns in a competitive market.

Frequently Asked Questions

What is Creator Check and how does it help content creators?

Creator Check is an automated transaction processing system designed to ensure timely payments to content creators, reducing delays that can affect trust and satisfaction. It streamlines invoicing and transaction processes, minimizing human errors and allowing agencies to focus on strategic growth.

What are the key benefits of using Creator Check?

The key benefits include timely payments to creators, reduced administrative burden on agencies, and minimized chances of transaction errors that could lead to disputes.

Why are clear payment terms important in influencer agreements?

Clear payment terms help avoid misunderstandings and disputes between influencer agencies and creators. Clearly outlining amounts, due dates, and compensation methods builds trust and transparency in the relationship.

What are some best practices for ensuring clear payment terms?

Best practices include using clear language to avoid jargon, documenting all financial details in writing, and regularly reviewing terms to keep them updated with business practices or market conditions.

What issues can arise from hidden fees in contracts?

Hidden fees can significantly reduce the profits of influencer firms. They may not be immediately obvious, and failing to identify and negotiate these fees can lead to organizations paying more than necessary for services.

How can agencies identify and negotiate hidden fees?

Agencies can identify hidden fees by thoroughly reviewing contracts for vague language, asking questions about potential fees, and negotiating terms to minimize or eliminate those hidden costs.