Overview

This article highlights why it's crucial to review contract clauses to avoid those pesky delayed payment risks. Have you ever faced confusion over payment terms? Identifying unclear payment terms is a key step. Plus, ensuring there are penalties for late payments and including dispute resolution provisions can really help protect your financial interests and boost your cash flow management.

So, what does this mean for you? It means taking these steps can make a big difference in keeping your finances on track!

Introduction

Navigating the intricacies of contract clauses is crucial for anyone involved in business agreements. These provisions do more than just outline the rights and responsibilities of everyone involved; they’re also key to managing the risks of delayed payments, which can really impact cash flow and operational efficiency.

So, as the stakes get higher, you might be wondering: how can you spot and tackle these risks through a careful review of contract clauses? This guide will walk you through the essential steps and tools you need to protect your financial interests and ensure successful negotiations.

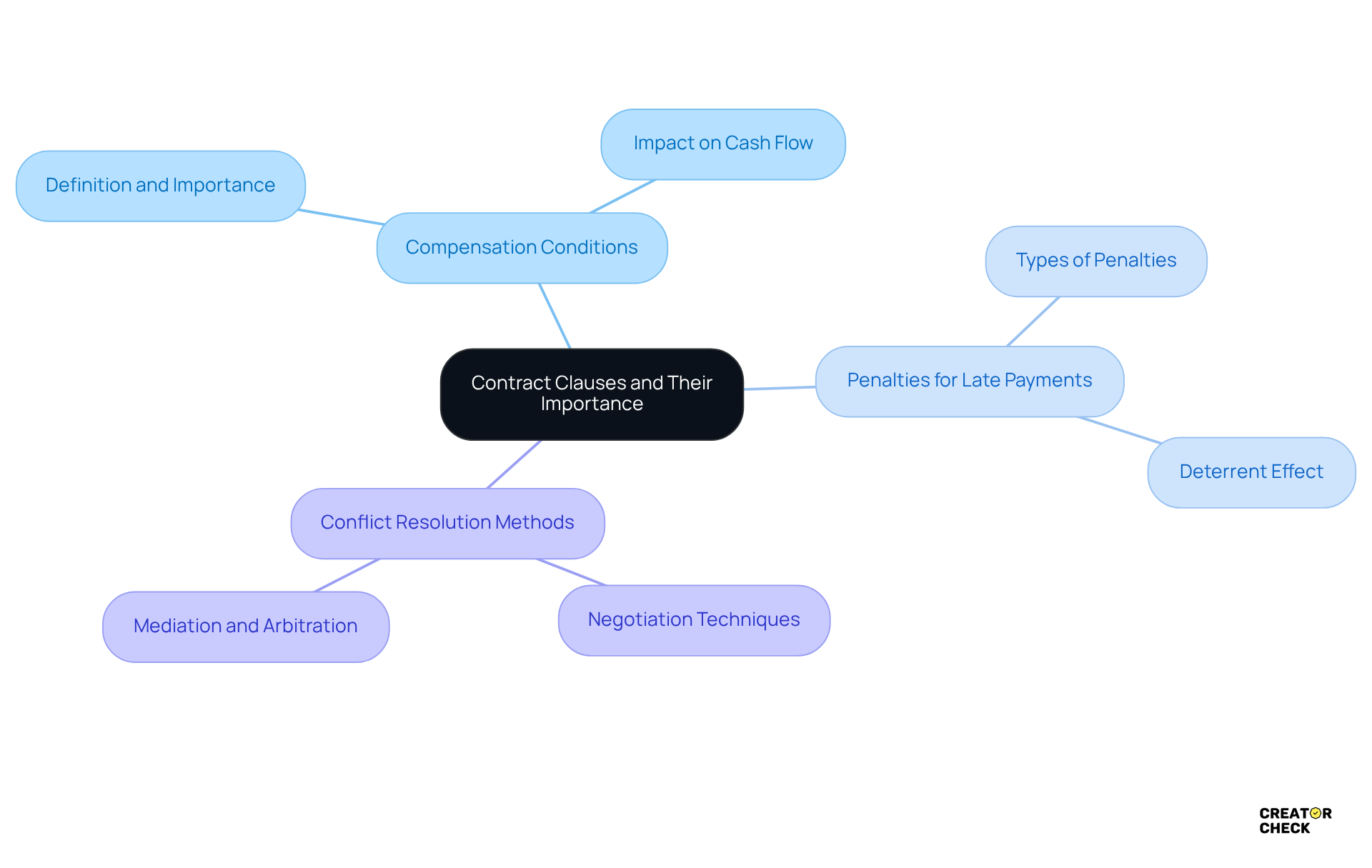

Understand Contract Clauses and Their Importance

Contract provisions are those specific parts of an agreement that lay out the rights and responsibilities of everyone involved. Think of them as the building blocks of any agreement—they are essential for the contract clause review for delayed payment risk. Understanding these provisions is super important because they can really impact your cash flow and how smoothly your operations run.

For instance, conducting a contract clause review for delayed payment risk involves provisions related to:

- Compensation conditions

- Penalties for late payments

- Methods for resolving conflicts

All of which are key to protecting yourself from financial risks. So, what does this mean for you? Getting familiar with these components can empower you to negotiate better terms and effectively safeguard your interests. It’s all about making sure you’re set up for success!

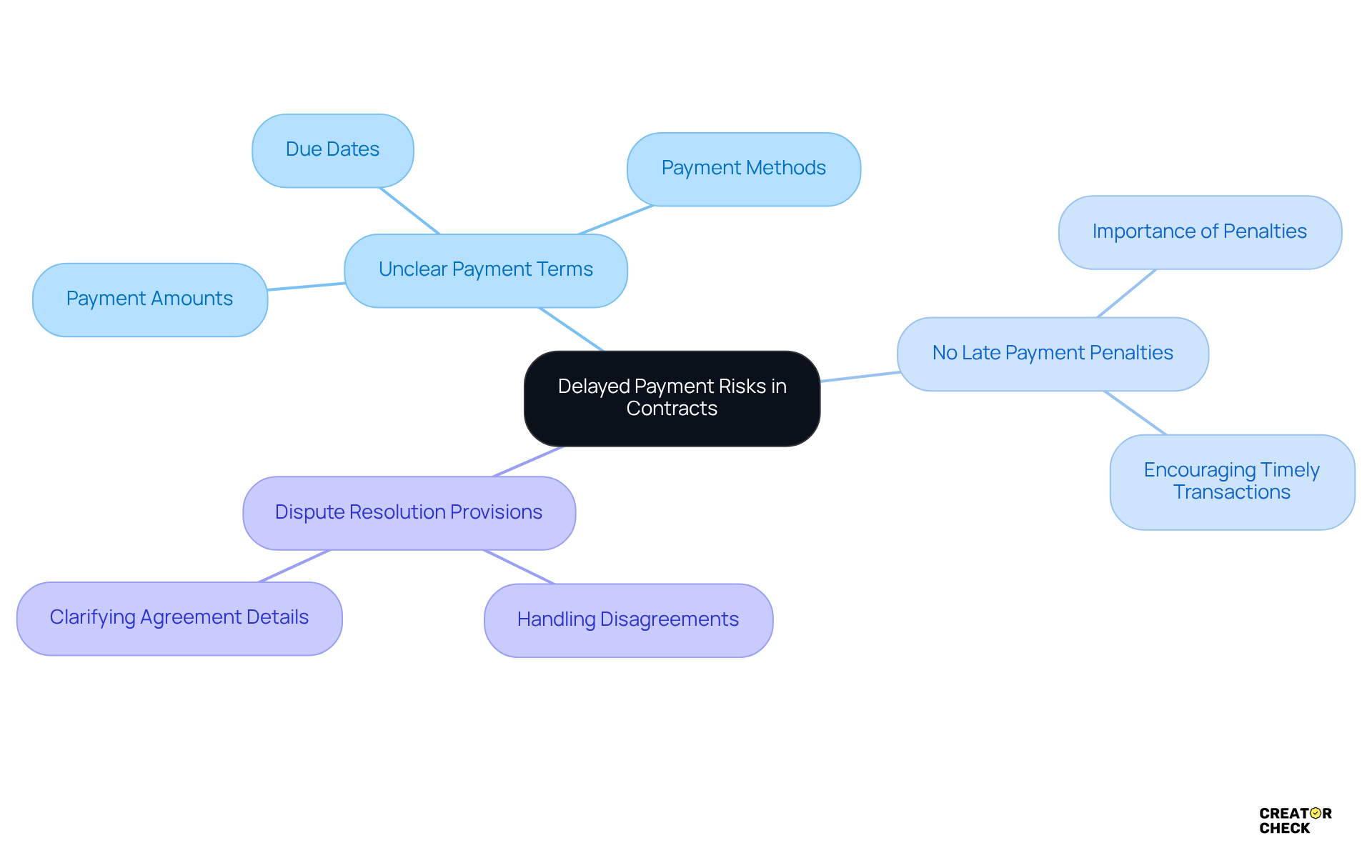

Identify Delayed Payment Risks in Contracts

To effectively manage delayed remuneration risks, we should conduct a contract clause review for delayed payment risk by examining the terms outlined in your contracts. Are there any unclear wordings about the payment schedule? This can easily lead to misunderstandings. Plus, keep an eye out for provisions that might limit your ability to impose penalties for overdue charges. Here are some common risks to consider:

- Unclear Payment Terms: Make sure payment amounts, due dates, and methods are clearly stated.

- No Late Payment Penalties: Your agreements should include penalties for late payments to encourage timely transactions.

- Dispute Resolution Provisions: These should specify how disputes will be handled, since delays often happen due to disagreements over the details of the agreement.

By identifying these risks through a contract clause review for delayed payment risk, you can negotiate better conditions and protect your agency’s financial interests. Remember, it’s all about setting yourself up for success!

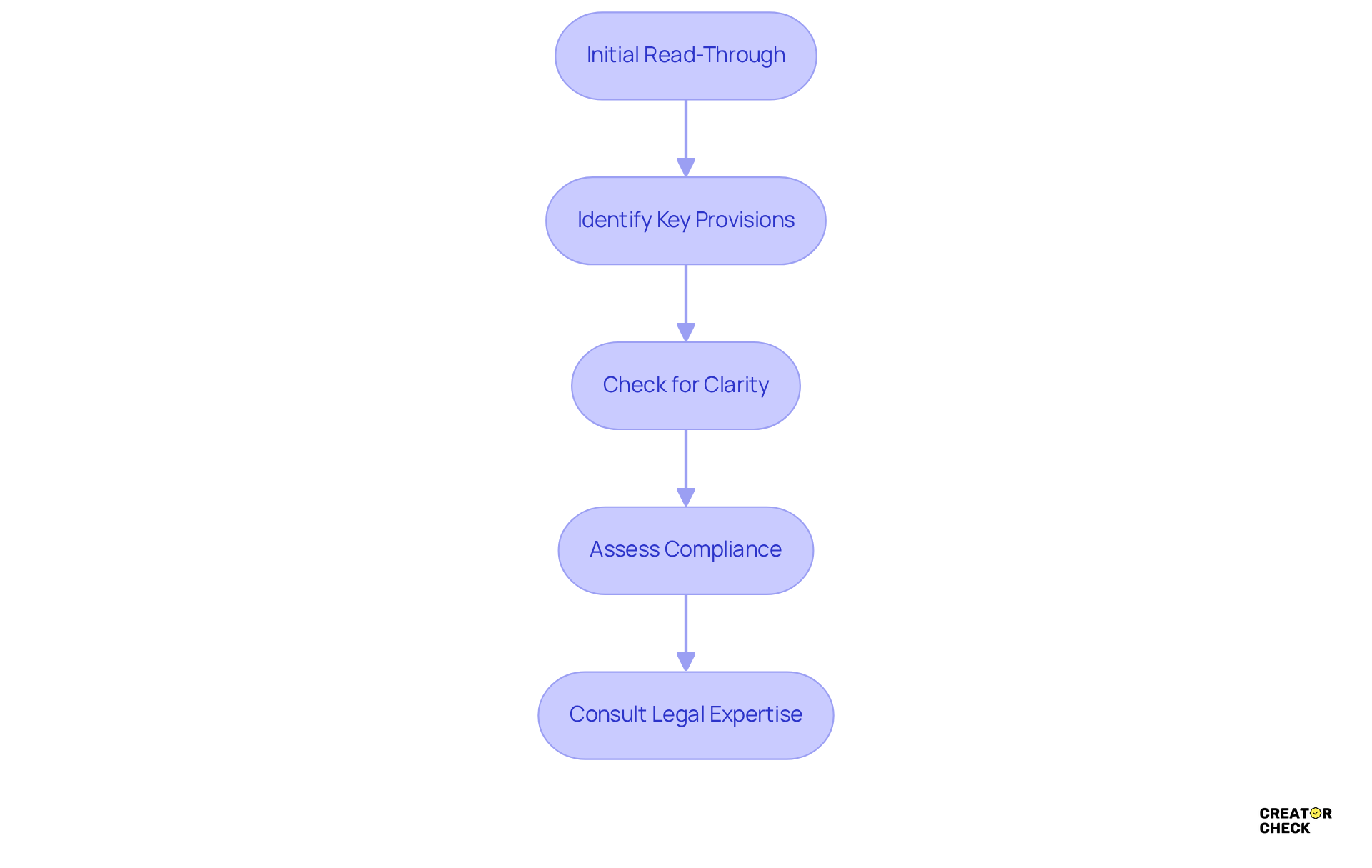

Conduct a Step-by-Step Review of Contract Clauses

To conduct a thorough review of contract clauses, follow these essential steps:

- Initial Read-Through: Start by taking a good look at the contract. This helps you grasp its overall structure and key points.

- Identify Key Provisions: Make sure to focus on important areas like compensation conditions, penalties for late transactions, and dispute resolution provisions. Highlight these for a closer look later.

- Check for Clarity: It’s vital that all terms are clearly defined. Any uncertainties can lead to disagreements and financial delays—common headaches in agreement management. As Sarah Lee points out, risks often stem from ambiguous language and unclear definitions.

- Assess Compliance: Ensure the agreement adheres to relevant laws and regulations, especially those related to financial practices. This step is crucial because compliance issues can lead to legal disputes and financial losses.

- Consult Legal Expertise: If things get tricky, don’t hesitate to reach out to legal counsel. They can help clarify complex clauses or negotiate terms that may not be in your favor. Having legal experts on your side can really give you peace of mind and protect your interests.

By following this organized method, you can spot potential issues and ensure your agreements are solid through a contract clause review for delayed payment risk. And here’s a little something to think about: statistics show that thorough contract clause review for delayed payment risk can significantly reduce the chances of payment disputes. Plus, using tools like Creator Check—an AI negotiator that saves agencies hours of manual work each week for just $25 a month per inbox—can really enhance your agreement management process. So, what do you think? Are you ready to take your contract reviews to the next level?

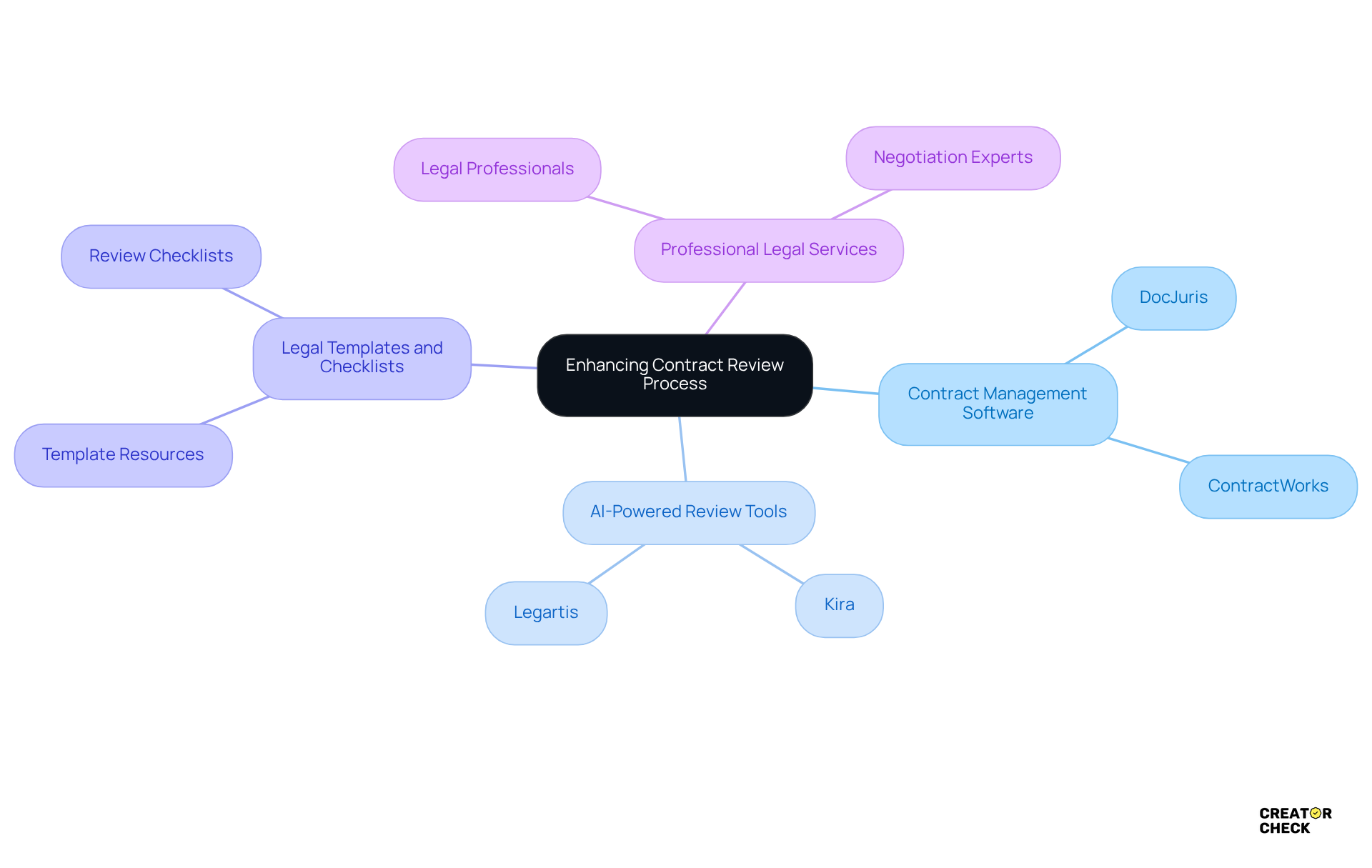

Utilize Tools and Resources for Effective Review

To enhance your contract review process, why not consider using some handy tools and resources?

- Contract Management Software: Platforms like DocJuris and ContractWorks can really help by automating the review process. They flag potential issues and ensure you're compliant with contract terms.

- AI-Powered Review Tools: Have you heard of Kira and Legartis? These tools use artificial intelligence to assess agreements quickly, pinpointing essential provisions and risks.

- Legal Templates and Checklists: There are plenty of resources online that offer templates for common agreements and checklists to make sure you review all the essential elements.

- Professional Legal Services: Engaging with legal professionals can provide valuable insights into those complex clauses and help you negotiate better terms.

By integrating these tools into your contract management process, you can enhance the contract clause review for delayed payment risk and boost your overall operational efficiency. So, what do you think? Ready to give these a try?

Conclusion

Understanding and managing delayed payment risks through a thorough review of contract clauses is crucial for protecting your financial interests. By getting a handle on the details of contract provisions, you can shield yourself from potential cash flow hiccups and keep your operations running smoothly. This proactive approach not only empowers you but also helps in negotiating better terms, setting you up for success.

So, how do you conduct a meticulous review? The article highlighted some key steps, emphasizing the need for:

- Clear payment terms

- The importance of late payment penalties

- The inclusion of effective dispute resolution mechanisms

Utilizing tools like contract management software and AI-powered review tools can really streamline this process. And don’t hesitate to engage legal expertise when necessary—navigating complex clauses can be tricky, and it’s all about minimizing the risk of financial disputes.

In today’s world, where contract management can significantly impact your business outcomes, dedicating time to a thorough review isn’t just a nice-to-have—it’s essential. By focusing on identifying and mitigating delayed payment risks, you can build healthier financial relationships and boost your overall operational efficiency. Embracing these practices will not only safeguard your interests but also pave the way for lasting success in your contractual engagements.

Frequently Asked Questions

What are contract provisions?

Contract provisions are specific parts of an agreement that outline the rights and responsibilities of everyone involved, serving as the building blocks of any contract.

Why is it important to understand contract provisions?

Understanding contract provisions is crucial because they can significantly impact cash flow and the smooth operation of business activities.

What is involved in a contract clause review for delayed payment risk?

A contract clause review for delayed payment risk involves examining provisions related to compensation conditions, penalties for late payments, and methods for resolving conflicts.

How can understanding contract clauses empower individuals?

Familiarity with contract clauses can empower individuals to negotiate better terms and effectively safeguard their interests, ultimately setting them up for success.