Overview

Net-30 payment terms mean you need to settle up within 30 days of the invoice date. On the other hand, net-60 gives you a bit more breathing room, extending that period to 60 days. This can really impact cash flow and how you manage finances in your business.

So, what does this mean for you? Choosing between these terms is all about finding that sweet spot between getting cash in quickly and giving your clients the flexibility they might need. This balance can play a significant role in how your agency operates and how you build those all-important client relationships.

It's a bit of a juggling act, isn’t it?

Introduction

Understanding payment terms is super important in the fast-paced world of business, where clarity can really make a difference in cash flow and client relationships. You’ve probably heard of Net-30 and Net-60—these are two common terms that define how long a buyer has to settle an invoice. They can influence everything from budgeting to your overall financial strategy.

But here’s the thing: choosing between these terms can be a bit of a dilemma. Shorter payment windows might boost cash flow, but longer terms can give clients the flexibility they need.

So, how do agencies strike that balance to ensure both profitability and trust? Let’s dive into this together!

Define Net-30 and Net-60 Payment Terms

What is net-30 vs net-60? These are common terms you might come across in business that explain how long a buyer has to pay an invoice after they receive it. So, what does that mean?

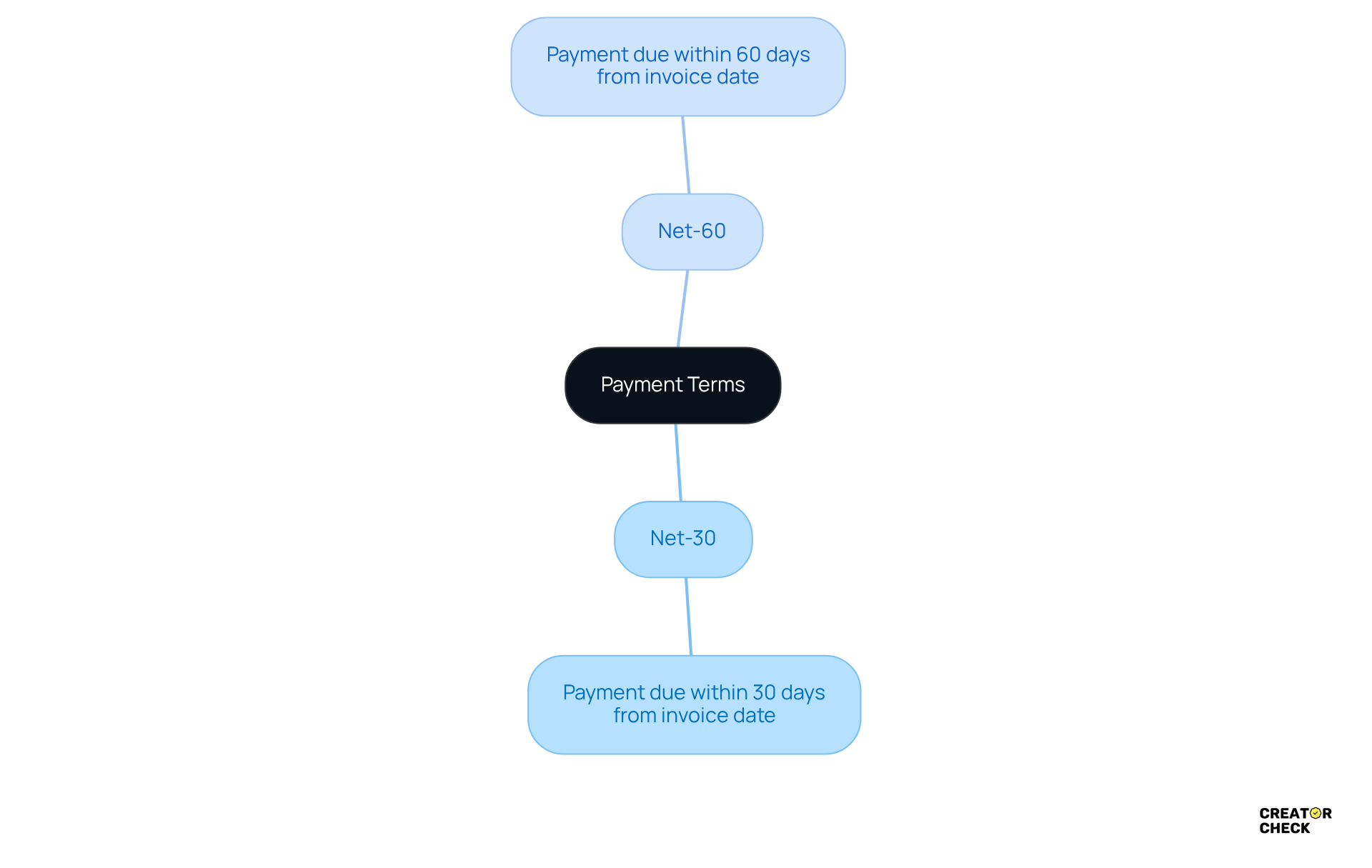

To understand what is net-30 vs net-60:

- 'Net-30' indicates that payment is due within 30 days from the invoice date.

- 'Net-60' extends that period to 60 days.

These terms are often included in contracts and bills to set clear expectations, helping businesses manage their finances smoothly. Understanding what is net-30 vs net-60 is crucial for both buyers and sellers. It helps keep those financial relationships positive and ensures that transactions happen on time.

Have you ever had to deal with these terms? It’s always good to know what to expect!

Context and Importance of Payment Terms in Business

Payment conditions play a crucial role in business. They set the stage for financial dealings, impacting liquidity, budgeting, and overall financial strategy. For organizations, especially those managing various creators and campaigns, clear financial terms can help avoid misunderstandings and ensure resources are available when needed.

In the influencer marketing world, where cash flow can be a bit unpredictable, understanding and negotiating favorable payment terms can significantly boost an agency's efficiency and profitability. Plus, these financial conditions can shape client relationships; timely payments build trust and reliability between everyone involved.

So, how do your payment terms stack up?

Compare Net-30 and Net-60: Key Differences and Impacts

So, what is net-30 vs net-60, and what’s the difference between these conditions? It all comes down to how much time you have to settle your payments. Understanding what is net-30 vs net-60, you’ll see that net-30 provides a shorter window to clear your dues, which can be a lifesaver for companies needing quick cash flow to keep things running smoothly. On the flip side, when considering what is net-30 vs net-60, net-60 gives customers a bit more breathing room to make those payments. This can be super helpful for folks with variable income or those managing bigger projects.

But here’s the catch: longer payment terms can put a strain on your agency’s cash flow. That might lead to delays in meeting your own financial obligations. So, it’s essential to weigh the perks of quicker transactions against the flexibility of extended terms. Consider your unique financial situation and how it fits with your client relationships. After all, finding the right balance can make all the difference in keeping your agency thriving!

Assess Risks and Considerations of Net-30 vs. Net-60

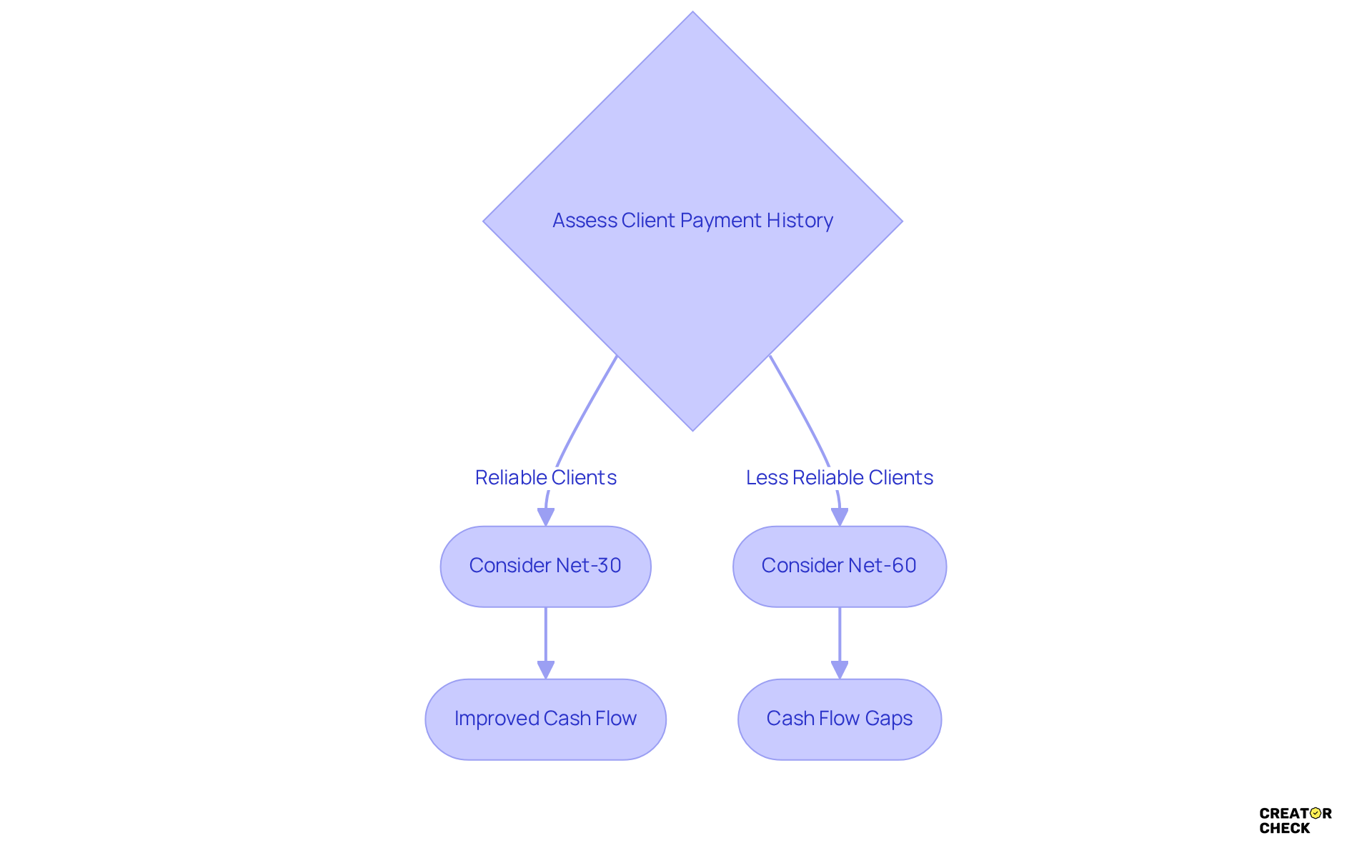

When you’re weighing the risks of what is net-30 vs net-60 arrangements, it’s important to think about your liquidity needs and how reliable your clients are. Sure, understanding what is net-30 vs net-60 can lead to quicker cash flow, but net-30 terms might also put pressure on clients who struggle to pay on time, which could lead to late payments or even disputes. On the flip side, while understanding what is net-30 vs net-60 reveals that Net-60 offers clients a bit more breathing room, it can create cash flow gaps for your agency, making it trickier to handle those unexpected expenses.

So, how do you decide? Take a good look at your client base, their payment history, and their financial stability before you settle on a payment term. It’s all about finding the right fit that aligns with your operational needs and risk appetite. Remember, choosing the right terms can make a big difference in how smoothly your agency runs!

Conclusion

Understanding the difference between net-30 and net-60 payment terms is super important for building solid business relationships and keeping your finances in check. These terms lay out when payments are due—net-30 means you need to pay within 30 days, while net-60 gives you a bit more breathing room at 60 days. Getting a handle on these concepts not only helps with cash flow management but also sets clear expectations between buyers and sellers, which boosts trust and reliability in business dealings.

Throughout this article, we've shared some key insights about what choosing between net-30 and net-60 terms really means. The shorter net-30 terms can help you get cash in quicker, which is crucial if your business needs that immediate liquidity. On the flip side, net-60 terms offer clients more flexibility, which can be a lifesaver for those with fluctuating income. But, let’s be real—this flexibility can also come with risks, like potential cash flow gaps for agencies. That’s why it’s so important to assess client reliability and payment history before locking in those payment terms.

So, what does this mean for you? The choice between net-30 and net-60 payment terms isn't just a simple preference; it's a strategic decision that can really affect your agency's operations and financial health. It’s essential to think about your unique situation and client dynamics when picking the right payment terms. By doing this, you can improve your financial management, strengthen your client relationships, and ultimately set your agency up for long-term success.

Frequently Asked Questions

What do net-30 and net-60 payment terms mean?

Net-30 and net-60 are payment terms that specify the time frame a buyer has to pay an invoice after receiving it. Net-30 means payment is due within 30 days from the invoice date, while net-60 means payment is due within 60 days.

Why are net-30 and net-60 terms important?

These terms are important because they set clear expectations for payment timelines, helping businesses manage their finances effectively and maintain positive financial relationships.

Where are net-30 and net-60 terms typically found?

Net-30 and net-60 terms are often included in contracts and bills to ensure both buyers and sellers understand their payment obligations.